Week of September 22, 2025

Jobs, Jobs, Jobs

The data over the past couple of weeks showed first that the economy ended the second quarter of the year stronger than previously thought, but then slowed in the third quarter (which ends on Tuesday). This was especially seen in the labor market, and Friday’s jobs report will be a critical data point. What does the third quarter have in store? That remains to be seen. Inflation remains high and if the labor market continues to downshift it will keep the Fed on high alert. Trade policy, which had appeared to be stabilizing, also turned upside down this past week with the President’s announcement that additional tariffs may be coming on medium and heavy trucks, kitchen cabinets, bathroom vanities, upholstered furniture, and pharmaceuticals.

Important Data Points From The Past Week

Canadian Industrial Price Index

Canadian industrial prices shot higher in August rising 0.5% from July and excluding energy they rose 0.7%. On a year-over-year basis industrial prices were up 4.9% (up from 3.8% in July), while excluding energy they were 4.0% higher (up from 2.6% in July). The driving force behind the acceleration in prices were higher prices for chemicals, food, vehicles, and primary non-ferrous metals. Looking at construction-related prices, they were mostly tame due to the slowdown in Canadian building permits.

U.S. New Home Sales

New home sales outperformed expectations in August, jumping 21% from July – this is the largest monthly gain since August 2022. The supply of homes on the market dropped to 7.4 months from 9.0 months in July, while the median sales price was $413,500 in August, up 4.7% from the previous month.

Lower mortgage rates and increased builder incentives were behind the higher-than-expected number, but even with this jump it just nudges my forecast up from the lower bound of around 2% for 2025 to maybe 4%. If this level of sales is sustained, I’ll raise my forecast, but I think it won’t be. Anecdotal evidence suggests that builders are paring back incentives while the labor market is slowing.

U.S. Durable Goods Orders

Orders for durable goods recovered in August, rising 2.9% following two consecutive monthly declines. Much of the increase was due to aircraft (both defense and nondefense) and when transportation orders (as a whole) are removed new orders rose 0.9%.

Released on the same day was the final revision for second quarter GDP, which showed that the US economy expanded by 3.8% in the second quarter, up from the previous estimate of 3.3%. The upward revision didn’t take away the fact that when trade is removed the economy contracted in the second quarter, but it did show that consumer spending and business investment was marginally stronger than previously anticipated. Putting the two together shows an economy that appears to be stable – not robust, but certainly not recession bound.

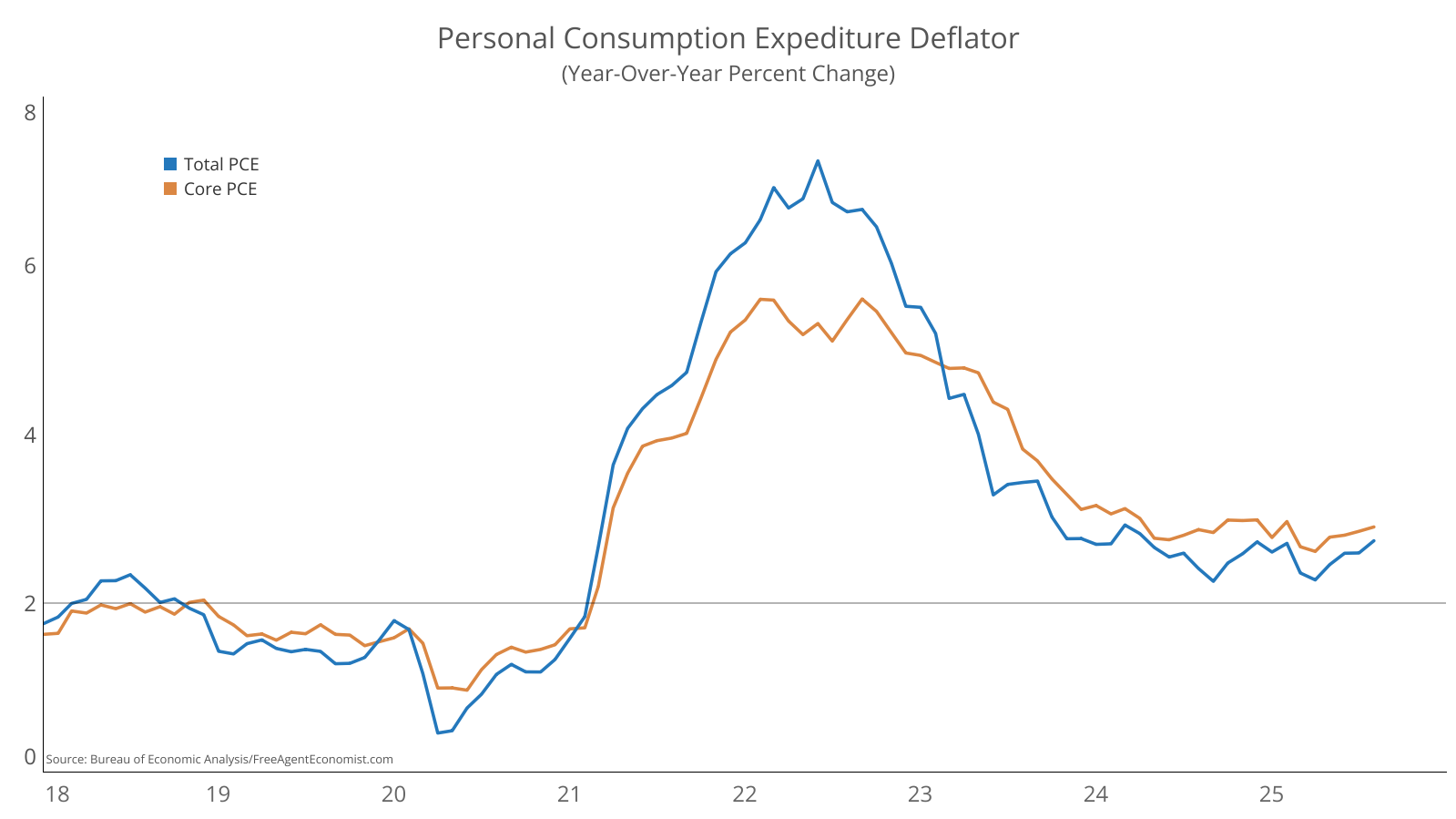

Personal Consumption Expenditure Delfator

The Fed’s preferred inflation measure was a little hotter than expected, increasing 0.3% over the month and accelerating the Y/Y measure to 2.7% from 2.6%. Food (+0.5%) and energy prices (+0.8%) were the biggest factors influencing the headline number. The core measure, which excludes food and energy, rose by a milder 0.2%, leaving the year-over-year growth rate steady at 2.9%. The Fed meets again at the end of October, and I’d say it’s 50/50 on a rate cut or not. The jobs number on Friday, I think, will be the key data point that they watch.

What I’ll Be Watching This Week

The start of a new month always brings a slew of important data. At the top of my list will be construction spending and the jobs report.

What I Watched Last Week

I’m just starting this show which is now in its fifth season. The show centers around a group of misfit MI5 agents led by the obnoxious Jackson Lamb, who is played by Gary Oldman. It’s a great show.

How Can I Help?

I’m taking on a limited number of clients to help with bespoke analysis of the economy and construction and what it means for your company. I’m also available if you’re in need of a speaker at an event or someone to come talk to leadership groups on the state of the economy, demographics, real estate, and construction.

If you want to discuss either option, sign up for a spot on my calendar.

Do you know someone who would benefit from the information in this newsletter? Please share the sign up link with them.