Week of September 15, 2025

Only Rate Cut In The Building

Some good news for the economy this week in that the Fed cut interest rates a quarter point in support of a slowing labor market. Also, the solid retail sales data showed that consumers stand ready to support the broader economy. That support – along with lower rates - should keep the labor market from breaking, just as tariffs will crimp hiring. In sum, this continues to support my working thesis that while the U.S. will bend over the coming months it should not break.

Important Data Points From The Past Week

U.S. Retail Sales

Retail sales inched forward in August, climbing 0.6% from July. Excluding auto sales, they rose 0.7%. Nonstore retailers (aka online/e-commerce) had a phenomenal month, climbing 2% while clothing and restaurant sales rose 1% and 0.7% respectively. The only real negative in the month was miscellaneous sales which fell 1.1%.

I don’t want to take anything away from the positive data, but there could be some back-to-school influence here – especially considering the weighting towards e-commerce, clothing, and sporting goods. Regardless, this is one of those data points that back up my assumption that while the economy will slow markedly in the months to come the consumer will be the bulwark of the economy.

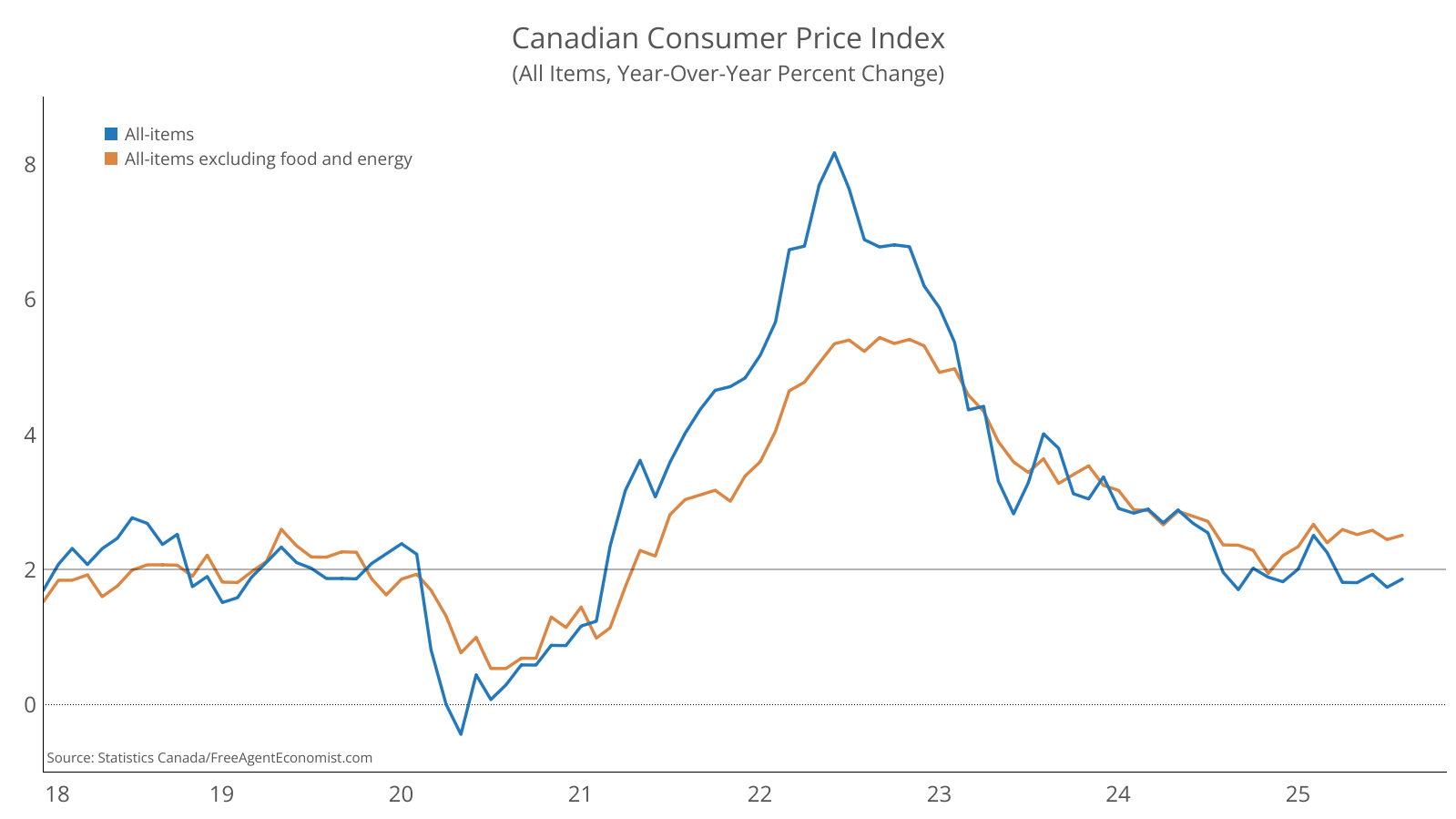

Canadian Consumer Price Index (CPI)

Canadian CPI edged slightly higher in August, climbing 0.2% from July. Core inflation (excluding food and energy) also rose 0.2% in the month. On a year-over-year basis, headline inflation accelerated from 1.7% to 1.9%, while core inflation posted a one-tenth increase to 2.5%. Food prices remain a thorn in the side of consumers led by meat and coffee, while gas prices fell. Shelter prices also fell as the slowing economy weighs on home values. Nothing dramatic in the data this month and coming in the same week as the Bank of Canada policy update, I think it has even less meaning.

Bank of Canada (BoC) Policy Update

Speaking of which, the BoC cut its benchmark rate by 25 basis points – the first rate cut in six months. There was pretty simple reasoning behind it: The trade war with the U.S. has led to job cuts in Canada and marked slowdown in the economy, and inflation remains tame.

The BoC seems to be hedging towards a more balanced outlook with the downside risks seemingly manageable, and of note they removed wording in the release about future rate cuts, which may suggest no cut in October. Lots of data to get through between now and then, but I think another cut is still on the table.

U.S. Housing Starts

Housing starts took a bit of a header in August, falling 8.5% from July. Single family starts were down 7%, while multifamily starts lost 12%. Starts were higher in the Northeast and West but fell in the South and Midwest. Perhaps most troublesome is that permits fell 3.7% - continuing their downward trend.

The risks to the economy and the slowing labor market (added to the already significant challenges the residential market is facing) are starting to wear on the housing market. While a Fed rate cut may help stimulate the economy and make a marginal improvement in starts, prices, labor, and credit availability for developers will prevent stronger growth. I’m still looking for multifamily starts to be up around 11-13% this year, which is a sign of just how bad starts were last year, while single family starts will be down around 4-5%.

FOMC Monetary Policy Decision

The FOMC cut rates by 25 basis points, lowering the Fed Funds target range to 4.00% to 4.25%. This is the first rate cut of 2025. Some notable elements from the press release were, “job gains have slowed, and the unemployment rate has edged up”. Later though, “inflation has moved up and remains somewhat elevated”. They further highlighted the importance of the Fed’s dual mandate and concerns on both sides of it but are currently weighing the risks to the labor market and the economy writ large as a higher concern.

Perhaps most telling was the “dot plot” – Fed’s own forecast of where rates will be – which suggests that there are two more 25 bps cuts coming before the end of the year. There was one dissenter in the voting bloc, new governor Stephen Miran wanted a cut of 50 bps.

Canadian Retail Sales

Canadian retail sales plunged in July, falling 0.9% (adjusted for inflation) from June. The only two categories to post a gain were auto sales and gasoline. Short-term barometers of consumer confidence – general merchandise, food and beverage stores, and clothing – all took sizeable hits. Retail sales were down in five of the ten provinces.

The data release also had a preliminary estimate for August, which showed a slight rebound. Regardless, data in Canada continues to point to an economy that is barely getting by.

What I’ll Be Watching This Week

In the U.S. we’ll see data on new home sales, durable goods orders, GDP, and inflation. A quieter week in Canada with just industrial inflation on Monday.

What I Watched Last Week

I’m not sure I’ve highlighted this show, but I’m doing so again because it’s so good. Martin Short and Steve Martin are legends, and Selena Gomez is growing on me as an actor (not so much on the music side). But I think the best thing about the show is how they use character actors each season to bring new depth to the story.

How Can I Help?

I’m taking on a limited number of clients to help with bespoke analysis of the economy and construction and what it means for your company. I’m also available if you’re in need of a speaker at an event or someone to come talk to leadership groups on the state of the economy, demographics, real estate, and construction.

If you want to discuss either option, sign up for a spot on my calendar.

Do you know someone who would benefit from the information in this newsletter? Please share the sign up link with them.