Week of September 8, 2025

After The Fire—The Fire Still Burns

The data this week was fairly resounding; highlighting that the while the inflation fire had started to die out, it has now reignited. The question is: will it stop the Fed from cutting this week? The answer is no – it won’t. The Fed will support the labor market and cut 25 bps this week, followed by another 25 in October and then December.

Important Data Points From The Past Week

U.S. Producer Price Index (PPI)

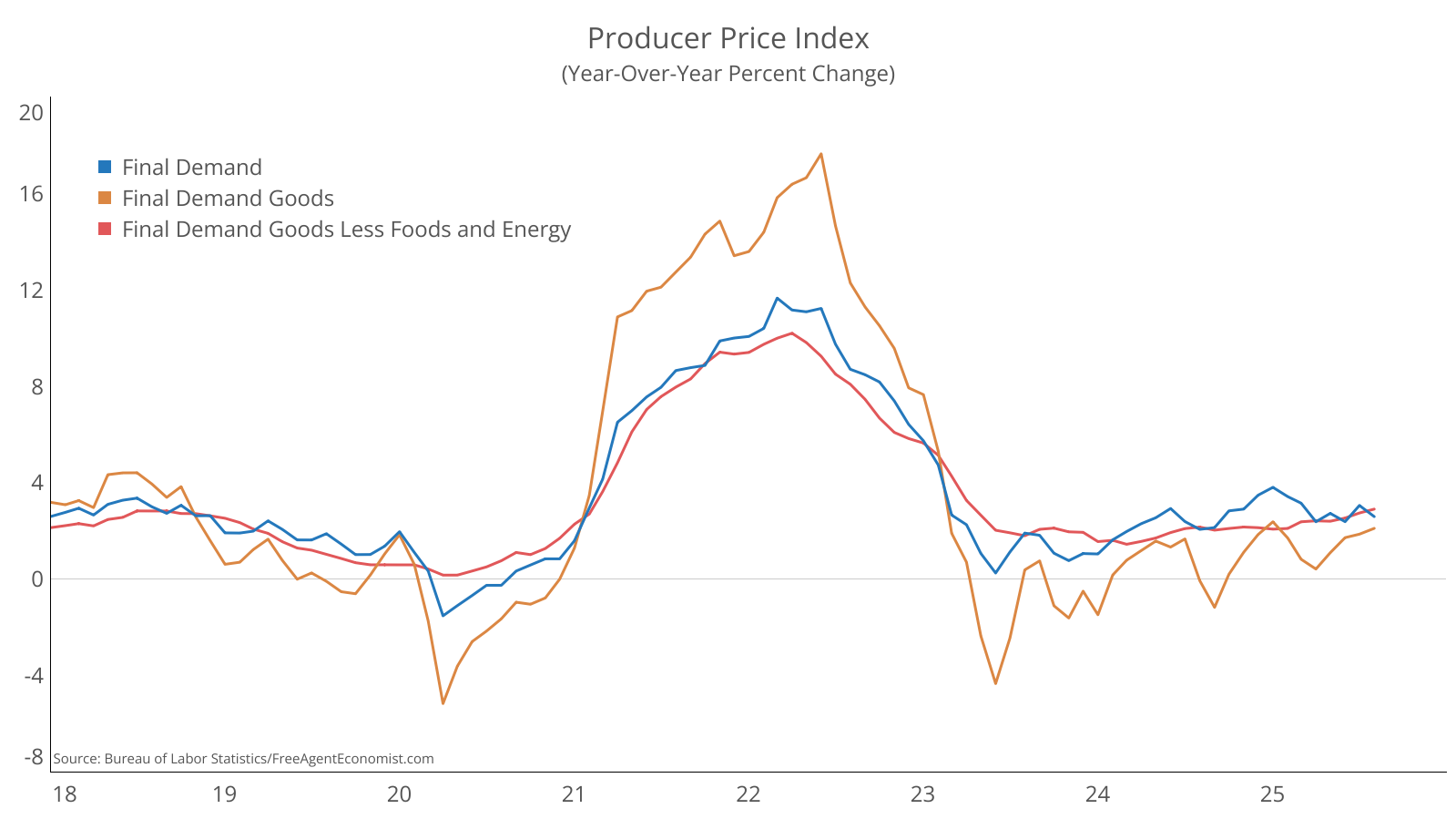

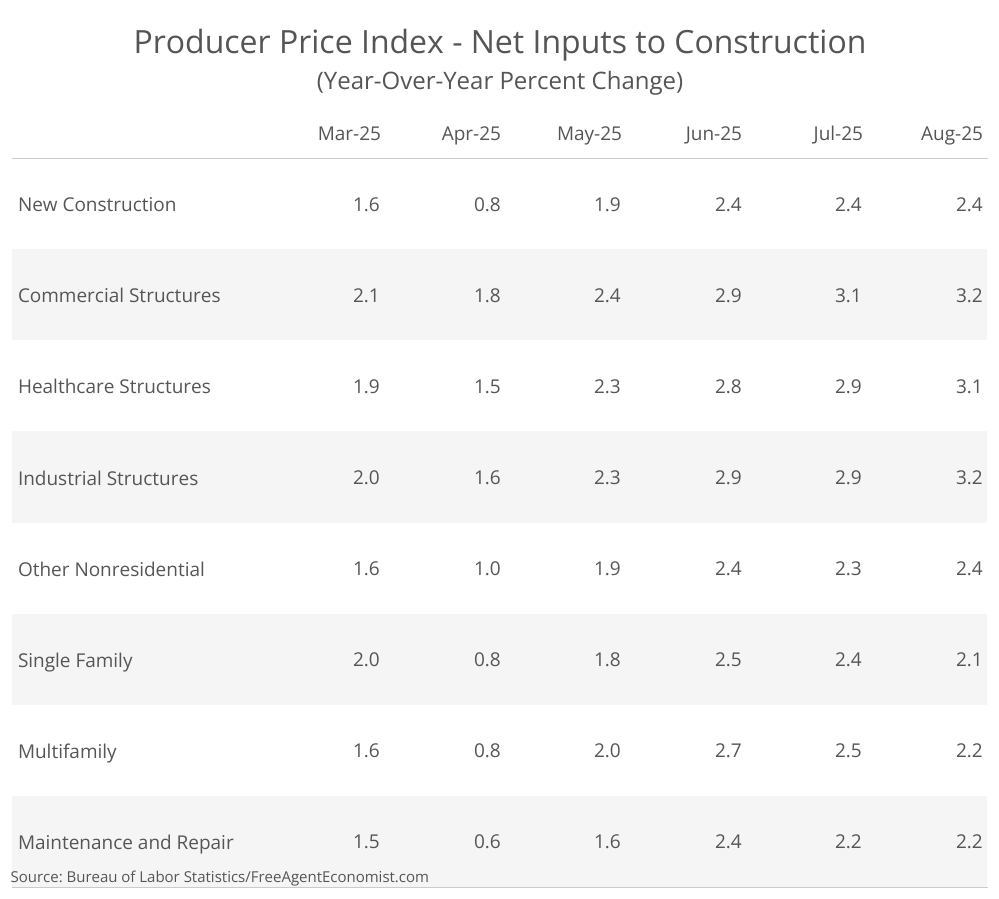

A surprise to the down side in wholesale inflation in August—the PPI for final demand fell 0.1%, mostly due to a decline in service prices; prices for final demand for goods rose 0.1%, which would have been more if not for a sharp pullback in energy prices. On a year-on-year basis the final demand price slowed from 3.1% in July to 2.6%, while core prices (excluding food and energy) sped up somewhat, rising from 2.7% in July to 2.8% in August. Construction-related prices accelerated slightly in the month, with residential being the exception—that’s likely due to reduced demand.

This is welcome news for the Fed and their concerns over a sharp pickup in inflation. For the most part, producers still seem leery in passing along higher costs. But they are slowing their hiring to make up for it.

U.S. Consumer Price Index (CPI)

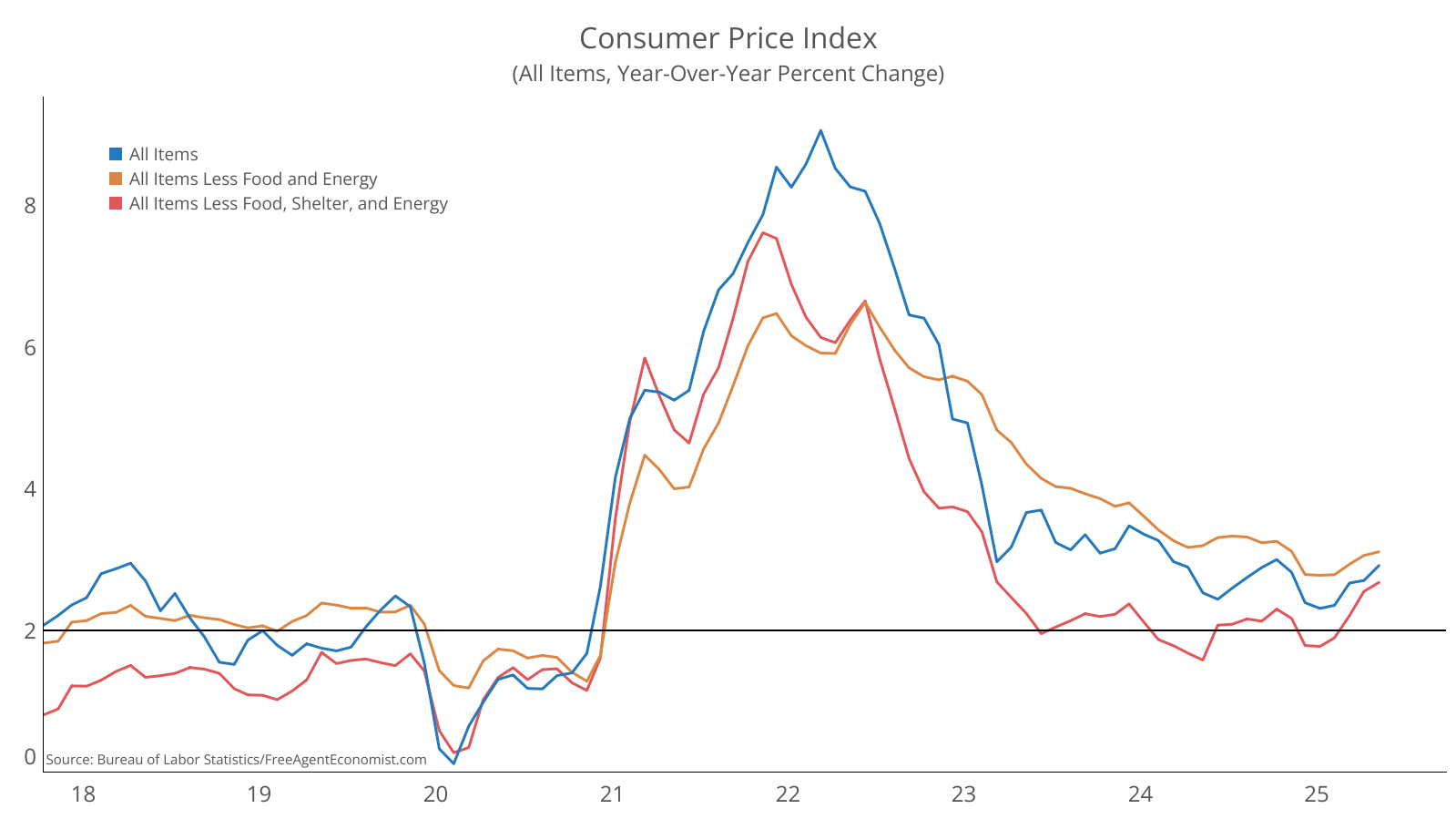

The August CPI data was everything that the PPI wasn’t—that is to say, consumer prices posted a sharp increase over the month. The all-items index rose 0.4%, the core (excluding food and energy) climbed 0.3% and the super-core (excluding food, energy, and shelter, rose 0.3%. On a year-over-year basis headline inflation accelerated to 2.9%, core increased to 3.1%, and the super-core rose to 2.7%.

While the PPI data was unambiguously favorable to the Fed in cutting rates this week, the CPI data raises doubt. I do think the Fed is going to put much more weight on the weakened labor market and cut—especially given the benchmark revisions to the employment data that showed fewer jobs have been added this year than expected.

Canadian Building Permits

Total Canadian building permits lost 0.1% from June to July. The decline was entirely due to the nonresidential building sector, which shed 6%. Residential permits were up 4% in July. On the nonresidential front, industrial and institutional permits were down (mostly in Ontario) while commercial activity was slightly higher. In residential, single family activity in Ontario was behind the increase, but multifamily also ticked slightly higher.

Construction permits in Canada have been resilient even though the economy seems to be tilting towards recession. This may reflect that the cause for the downturn—tariffs with the U.S.—may disappear at any moment. News on that front has been strangely quiet. I’m taking that as a hopeful sign that there is a lot of work going on behind the scenes to find a resolution.

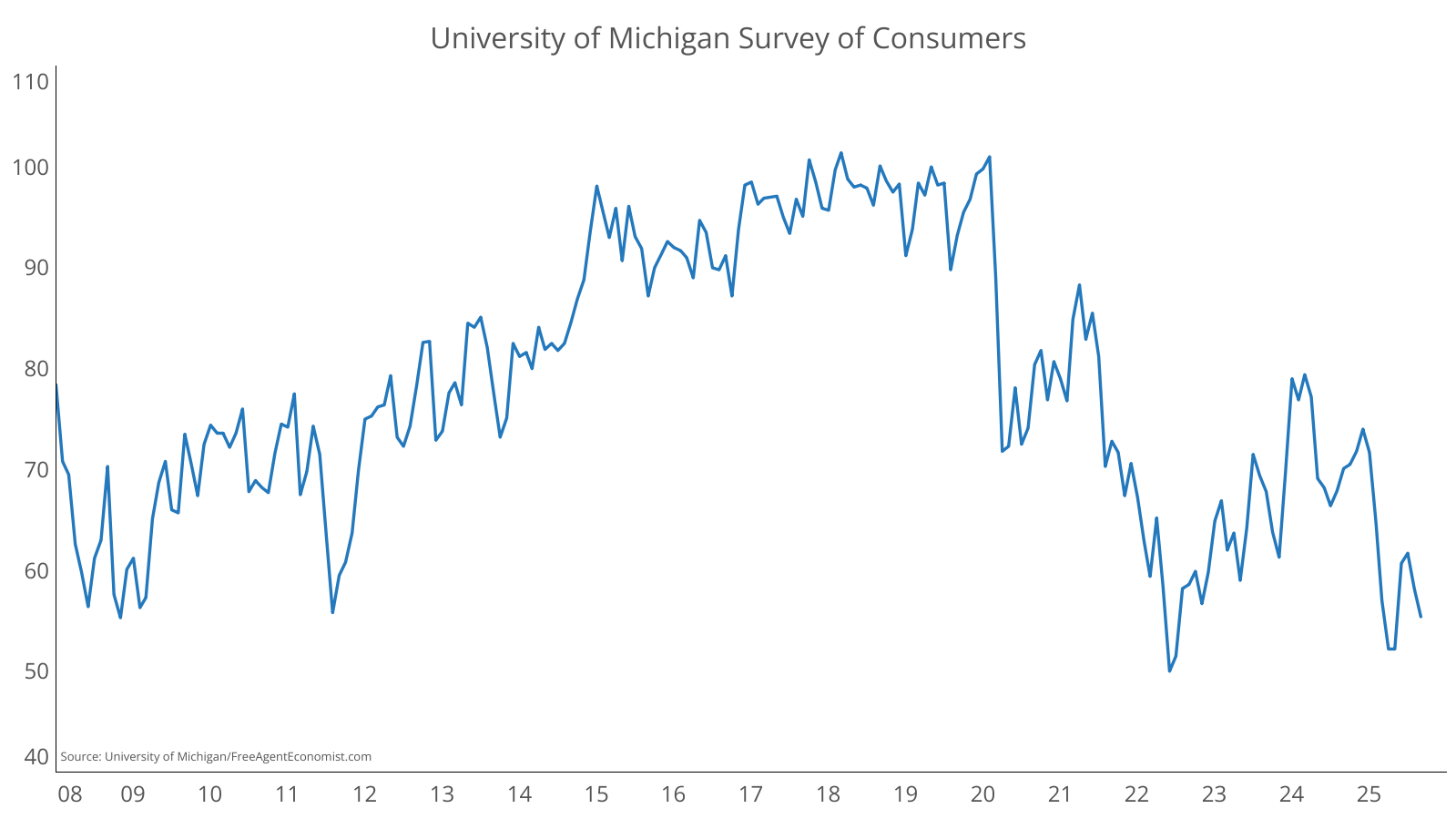

University of Michigan Survey of Consumers

Consumer confidence fell in September, losing three points from August. Much of the decline was due to future expectations in the direction of the economy, while feelings on the current state change little from August.

I don’t think this is terribly surprising given the labor market data over the last couple of months—over 20% of respondents feel that they will lose their job over the next five years, while over 60% of respondents feel that unemployment will rise over the next 12 months. Consumers are the canary in the coal mine for the economy, and they are sounding the alarm!

What I’ll Be Watching This Week

Yikes. What won’t I be watching?? In the U.S. we’ll see retail sales, housing starts, and a monetary policy update from the Fed. In Canada, we’ll also get an update from the Bank of Canada on interest rates, consumer inflation data, and retail sales.

What I Watched Last Week

The Marvel franchise has been through a lot over the past few years since Avengers Endgame. Not surprising I suppose given the number of A list actors that left the series after that movie. Is this the new team that can carry the mantle forward?? I doubt it—very one-dimensional characters. Florence Pugh is a standout, though.

How Can I Help?

I’m taking on a limited number of clients to help with bespoke analysis of the economy and construction and what it means for your company. I’m also available if you’re in need of a speaker at an event or someone to come talk to leadership groups on the state of the economy, demographics, real estate, and construction.

If you want to discuss either option, sign up for a spot on my calendar.

Do you know someone who would benefit from the information in this newsletter? Please share the sign up link with them.