Week of September 2, 2025

Did The Other Shoe Just Drop?

This week started with all eyes on the jobs report on Friday, and if nothing else the report was definitive. The labor market is rapidly cooling and with it the odds of recession are climbing.

But the odds of a rate cut on the 17th are also very high. At this point 25 bps is a safe bet, along with 25 in both October and December.

Important Data Points From The Past Week

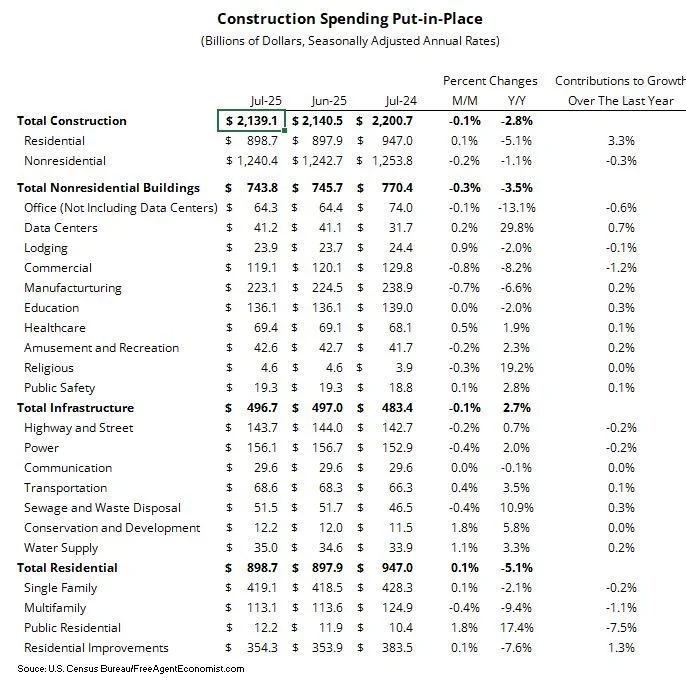

Construction Spending Put In Place

Total construction spending slipped 0.1% from June to July to a seasonally adjusted annual rate of $2.1 billion. Nonresidential spending was down 0.2%, while residential spending rose 0.1%. On a year-over-year basis, total construction spending was 2.8% lower than 2024. Lodging, healthcare, water supply, and data centers all posted gains, while power, highway and street, commercial, and manufacturing were lower.

Keep in mind that the spending data is backward looking in that these projects broke ground towards the end of last year and early in 2025. As you may recall, starts were moribund back then. What’s changed? Not much really, tariff and material prices are still concerning as are high rates and lack of labor. Now though, economic activity and confidence are much lower. That doesn’t portend well for starts and thus spending over the short term. In the meantime, I’m looking at total construction spending barely moving forward in 2025.

U.S. Jobs Report

The U.S. economy added 22K jobs in August – the continuation of a rapid erosion in the labor market. The jobs numbers were once again skewed towards a small number of sectors that added jobs – particularly healthcare, which added 47K jobs. Construction jobs were down 7K during the month – the bulk of that in residential specialty trades and nonresidential building construction. A bright note, though, in that heavy and civil jobs rose by just a hair over 2K.

This is not a good report and by extension paints a bleak picture of the state of the U.S. economy. For those already forecasting a recession (there are a few) you just scored points. For those on the fence (including me), we may have just tilted one way. Regardless, this all but confirms a Fed rate cut in just over a week despite the fear of rising inflation.

Canadian Jobs Report

The Canadian economy lost 66K workers in August and a total of 106K over the last two months. On the plus side, wholesale trade and construction added 28K and 17K respectively, while retail and professional workers were down 30K and 26K. More telling were transportation and warehousing, which together lost 42K workers – those sectors obviously heavily impacted by trade with the U.S.

When looking at the July and August figures it’s hard to not see this as recessionary and for Canada it’s hard not to see this improving until the trade situation improves. It’s good that the Bank of Canada has been holding off on cutting rates further. Still, lots of dry powder to use, and I would expect a rate cut in mid-September.

What I’ll Be Watching This Week

In the U.S. there will be two inflation data points from the perspective of both consumers and producers along with The University of Michigan Consumer Sentiment Survey. In Canada we’ll see data on building permits.

What I Watched Last Week

I feel beholden to report not just on the shows and movies I liked, but also those that I did not. I had high hopes for this series, but it’s just ok. To be honest I’m finishing it out, not because I want to but because I feel I must.

How Can I Help?

I’m taking on a limited number of clients to help with bespoke analysis of the economy and construction and what it means for your company. I’m also available if you’re in need of a speaker at an event or someone to come talk to leadership groups on the state of the economy, demographics, real estate, and construction.

If you want to discuss either option, sign up for a spot on my calendar.

Do you know someone who would benefit from the information in this newsletter? Please share the sign up link with them.