Week of Aug 25

Anything But Quiet

August is usually a quiet month in the business world, but the data this month was anything but. This past week was a case in point as we received further confirmation that the housing market is cracking, that the U.S. economy is slowing, and that inflation is rising. Not a great combination. The jobs report on Friday will be critical for any Fed watcher, and could start September off with a bang!

Important Data Points From The Past Week

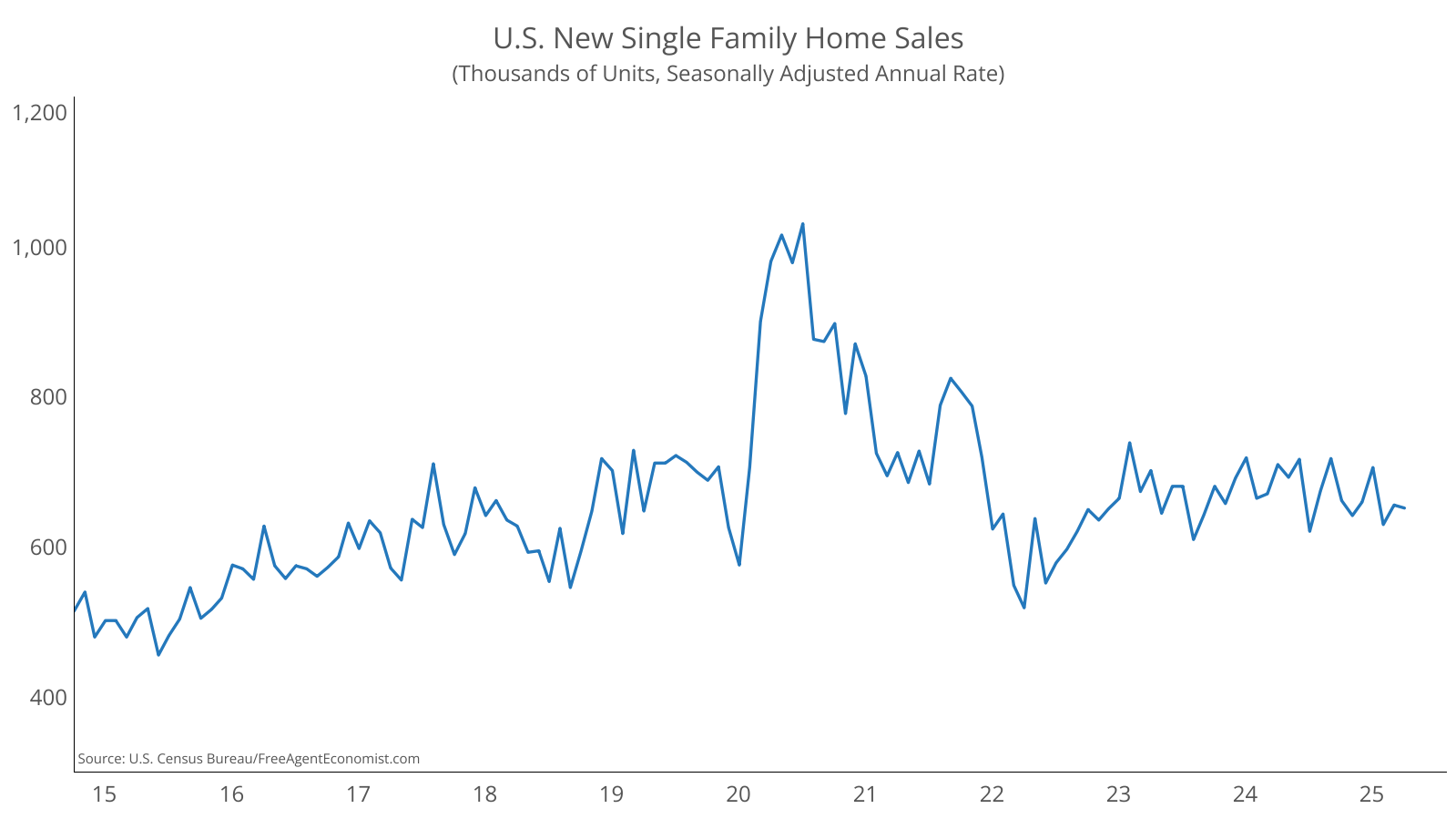

U.S. New Home Sales

New homes sales lost 0.6% from June to July, falling to a seasonally adjusted annual rate of 652,000. The median sales price also fell, dropping 0.8% to $403,800 and the months supply of homes remained at 9.2.

Home sales have been flatlined over the last year as potential buyers sit on the sidelines and watch the economic scenario play out. The jobs picture isn’t very encouraging, and I think home sales will struggle to meet my forecast for this year. That being said, I’ll need one more month of data before I decide to push my outlook lower.

U.S. Advance Durable Goods Orders

New orders for nondefense capital goods, excluding aircraft, rose 1.1% from June to July and are 2.3% higher than last year. Note that this data is in nominal dollars, so in real terms orders were flat-to-down at best. Orders for computers, electrical equipment, and primary metals were especially healthy.

The manufacturing space has seen a wide swath of negative data over the last few months, so seeing some resilience in orders and shipments is reassuring. The outstanding question with the data is whether this is restocking of goods following the massive outlay in orders earlier in the year to beat tariffs or a more organic rise that one would expect in a healthy economy. My sense is that it’s the former, not the latter.

U.S. Gross Domestic Product (GDP)

The second estimate of second quarter GDP showed that the U.S. economy expanded by an annualized 3.3% in the second quarter, up slightly from the first estimate of 3.0%. Like all economic data, GDP is subject to revisions as more information becomes available. Under the hood there were not any significant changes to the estimates for consumer spending (still weak) and net exports. Business investment did post a healthy positive revision due to investment in equipment and intellectual property.

Take net exports out of the 3.3% GDP read, and you’ll see the that the U.S. economy contracted by 1.7% in the second quarter. Confirmation that the U.S. economy was starting to slip as the midpoint of the year approached. The jobs report this week will be a critical watch.

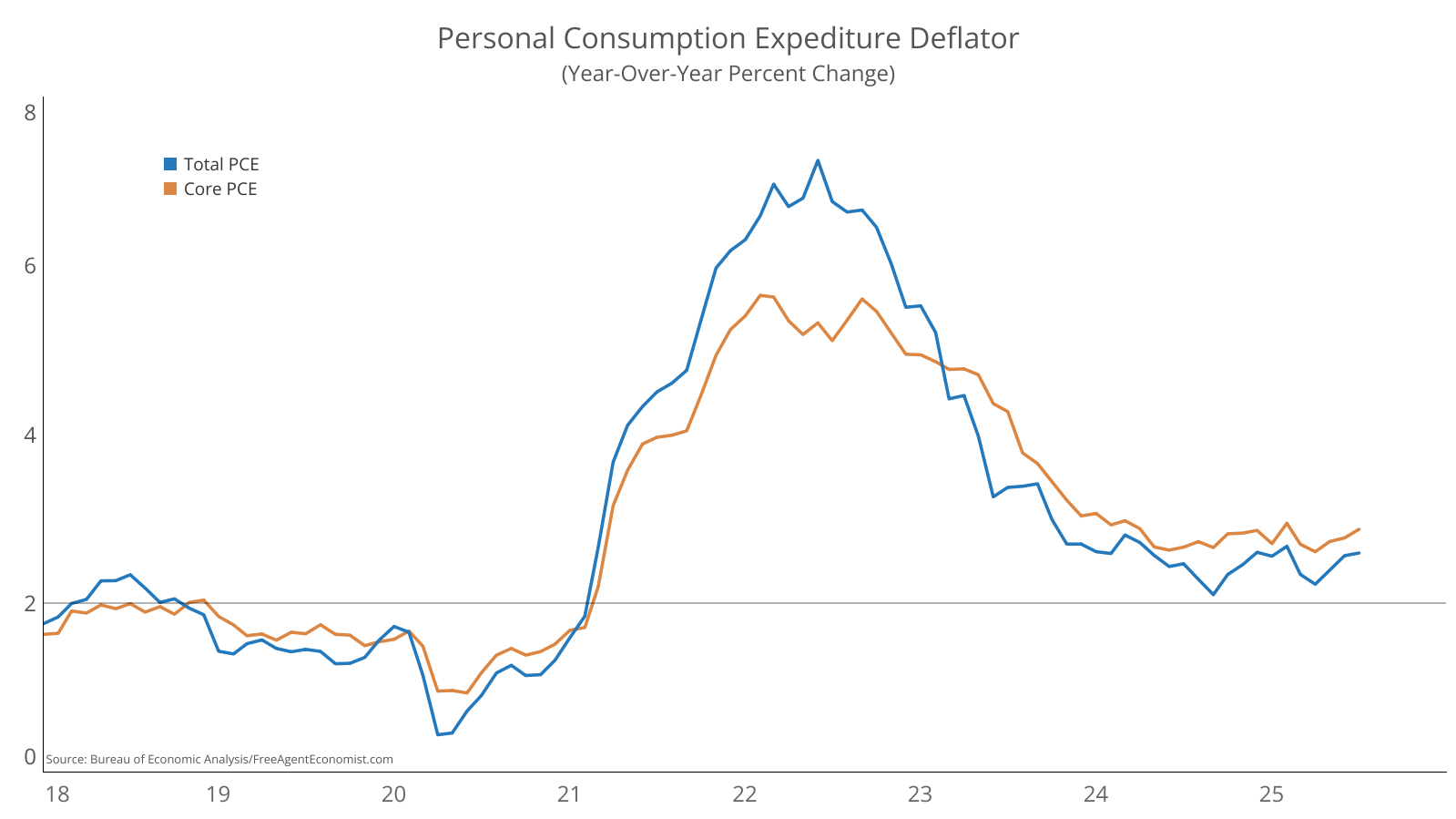

U.S. Personal Consumption Expenditure Deflator (PCE)

Core inflation (excluding food and energy) as measured by the PCE deflator – the Fed’s preferred measure of inflation – rose 0.3% from June to July and is now up 2.9% from a year ago (up slightly from 2.8% in June). The report also showed that inflation adjusted income and spending were marginally higher.

What’s the Fed to do with this data? I would think it reduces the odds of a Fed cut in September – unless the jobs report this week shows that the labor market continues to erode.

What I’ll Be Watching This Week

In the U.S. we’ll see construction spending and the all-important jobs report on Friday. Canada will also see a jobs report on the same day.

What I Watched Last Week

I’ll admit it. I’ve always wanted to be Pierce Brosnan … Remington Steele, James Bond, Sam from Momma Mia. Ok, maybe not the last one. This was a good movie, not as good as the book but a good watch. Oh, and my third movie with Helen Mirren in as many weeks. She’s everywhere.

How Can I Help?

I’m taking on a limited number of clients to help with bespoke analysis of the economy and construction and what it means for your company. I’m also available if you’re in need of a speaker at an event or someone to come talk to leadership groups on the state of the economy, demographics, real estate, and construction.

If you want to discuss either option, sign up for a spot on my calendar.

Do you know someone who would benefit from the information in this newsletter? Please share the sign up link with them.