Week of Aug 18

Waiting On A Friend

In a speech this week at Jackson Hole, Fed Chairman Jay Powell noted “the shifting balance of risks may warrant adjusting our policy stance.” Heady words considering the intense pressure that he must be under.

The data last week wasn’t notable from a Fed perspective but looking ahead to this week (PCE inflation) and next (jobs data) I think we’ll get a much clearer sense of which way the wind is blowing for the Fed meeting in mid-September.

Important Data Points From The Past Week

U.S. Housing Starts

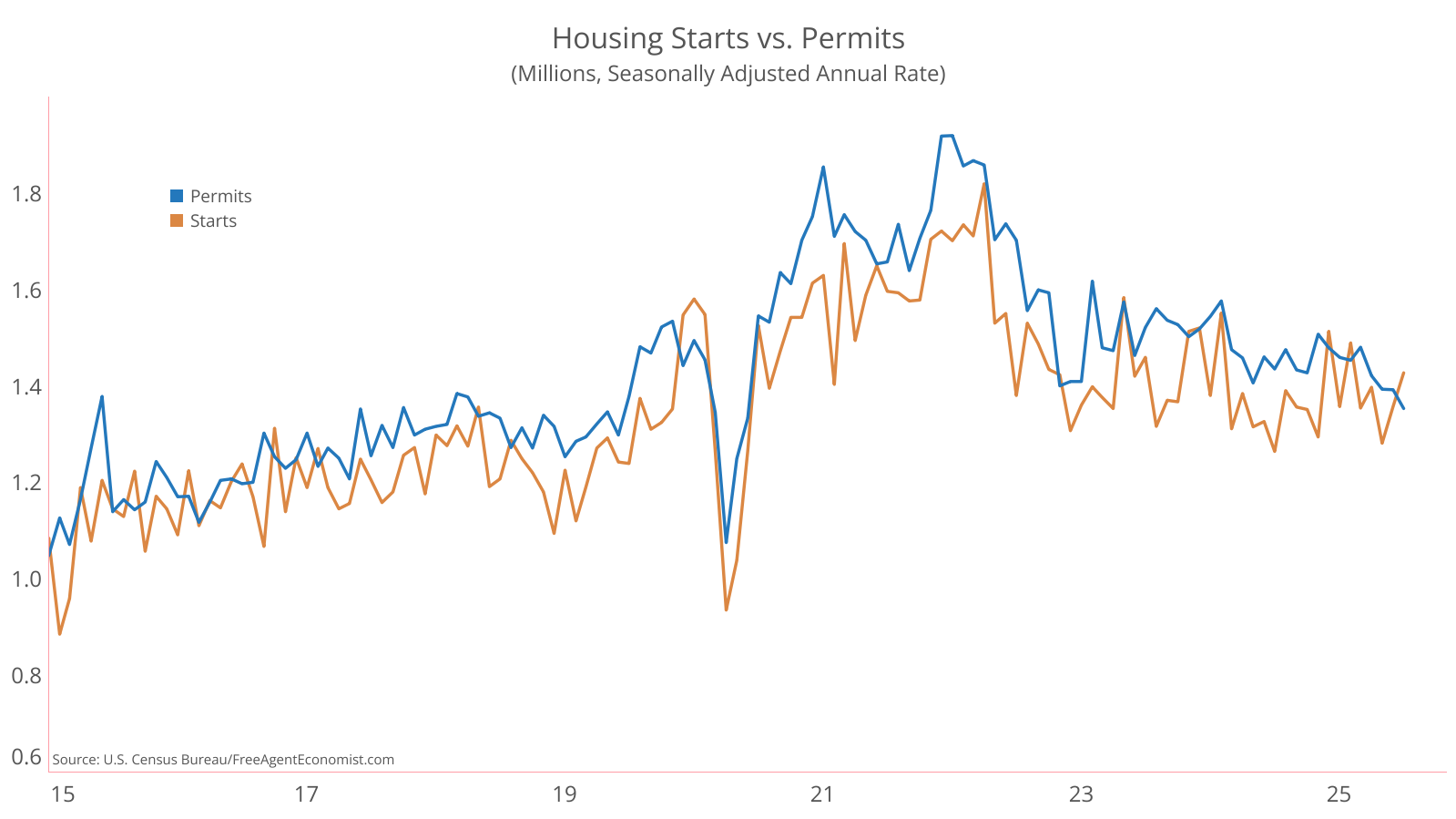

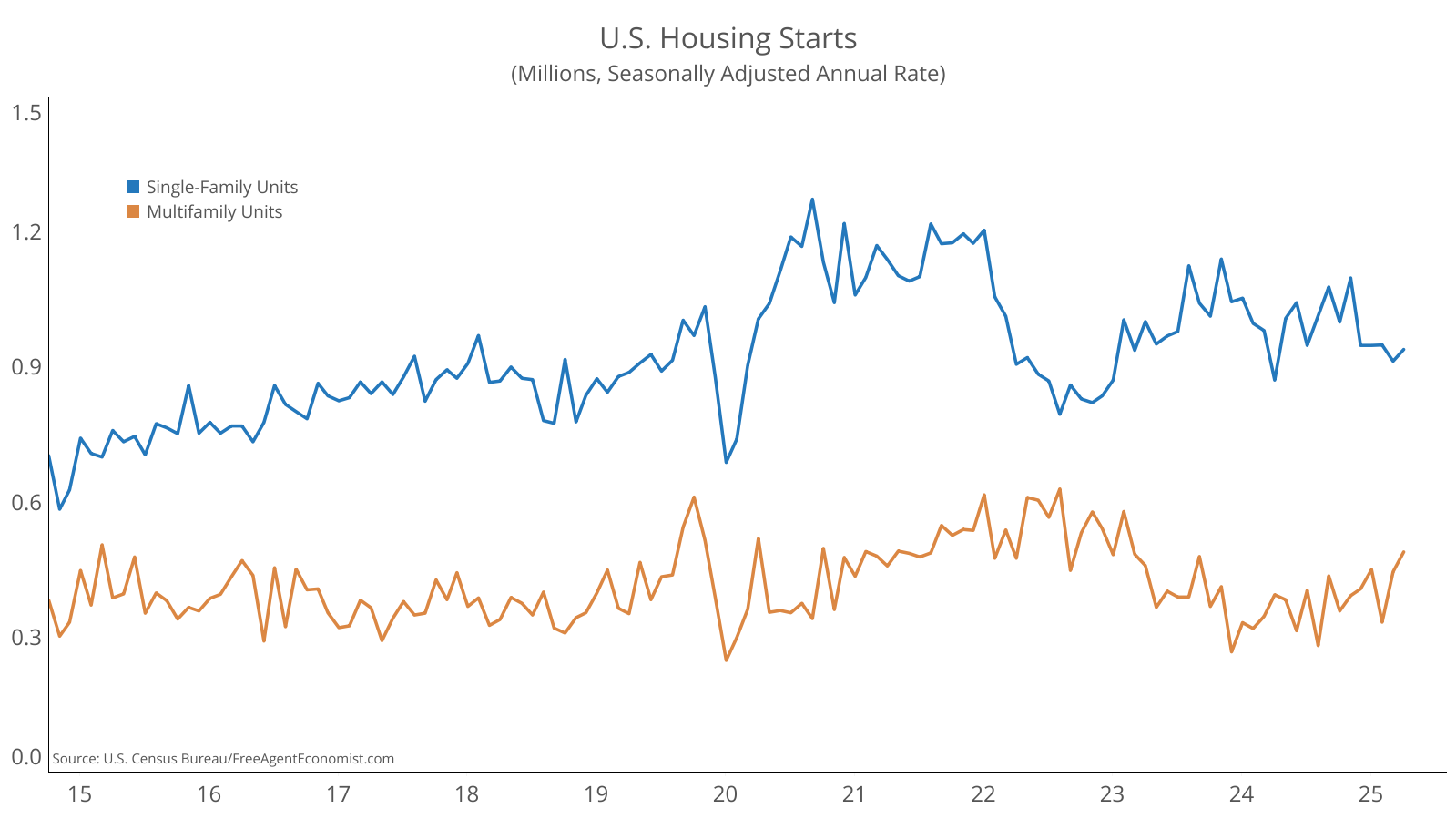

U.S. housing starts posted a nice uptick in July, growing 5.2% from June to 1.4 million units on a seasonally adjusted annual rate basis. Single family starts rose 2.8%, while multifamily starts rose 10%. Not so great news on the permitting front though. Total permits lost 2.8% - single family permits were up 0.5%, while multifamily permits were down 8.2%.

I don’t want to take away the good news in the report since it was especially above what most people (myself included) expected out of the single family space. But that’s not sustainable given how low permits are right now. Multifamily starts were solid (in line with my expectations) and should continue to be healthy given the massive affordability issues in the single family market.

Canadian Consumer Price Index (CPI)

Canadian CPI posted a 0.3% month over month increase in July – good enough to lower the annual rate from 1.9% to 1.7%. Core prices (excluding food and energy) rose 0.1% from June to July leading to the annual rate slowing to 2.5% from 2.6%. Shelter, motor vehicle, and food prices remain troublesome and are leading to sticky inflation.

The data was broadly in line with expectations and that means that the Bank of Canada will likely hold rates steady in September.

FOMC Meeting Minutes

The minutes released last week reflect the thinking of the Fed when they last made a policy decision on July 30 and how they weigh the current risks to the economy. On that note, here is the direct quote: “a majority of participants judged the upside risk to inflation as the greater of these two risks, while several participants viewed the two risks as roughly balanced, and a couple of participants considered downside risk to employment the more salient risk.” The latter two were likely the dissenters who advocated a rate cut.

Given the inflation data from two weeks ago I wonder if those two will have changed their mind. With the next FOMC meeting on September 16-17 the next jobs report will be critical.

Canadian Industrial Product and Raw Material Price Index

Prices for products manufacturing in Canada moved higher in July. The total industrial price index moved from 1.9% on a year-over-year basis to 2.6%, and the core measure (excluding energy) moved from 3.1% (Y/Y) to 3.8%.

Energy prices (specifically diesel) shot higher due to low stock in both the U.S. and Canada, but precious metal prices also moved higher along with prices for electrical cable and wires. On the downside, motor vehicle prices, fabricated metal, and construction material prices moved lower.

Canadian Retail Sales

The Canadian consumer shook off any economic or tariff concerns in June as inflation adjusted retail sales increased 1.5%. Sales were up in all major categories. Interestingly, as part of the supplemental questions, 27% of retail businesses reported being impacted by trade tensions, down from 32% in May.

The report also gives an advance read of July sales, which are estimated to be down 0.8% from June. While that might be in tune with my overall thinking that the consumers will pare their spending, only 55% of retailers have reported sales (the usual rate in 90%) so there may be a substantial revision to that figure.

What I’ll Be Watching This Week

In the U.S. we’ll see new home sales, durable goods orders, GDP and an inflation read. In Canada, GDP data will be released on Friday.

What I Watched Last Week

In the vein of The Diplomat this political thriller follows the events surrounding the kidnapping of the British Prime Minister’s husband. Not great, but not bad either.

How Can I Help?

I’m taking on a limited number of clients to help with bespoke analysis of the economy and construction and what it means for your company. I’m also available if you’re in need of a speaker at an event or someone to come talk to leadership groups on the state of the economy, demographics, real estate, and construction.

If you want to discuss either option, sign up for a spot on my calendar.

Do you know someone who would benefit from the information in this newsletter? Please share the sign up link with them.