Week of Aug 11

If You Want Inflation

(You’ve Got It)

The title this week is a spoof of an AC/DC song - If You Want Blood (You’ve Got It). It came up on my random Spotify playlist while walking my dog on Friday morning. Picture a mid-50s male head-banging his way down the road while walking a 17-month-old mini-Goldendoodle. It was a sight to behold.

But, back to the subject, the data last week showed that tariffs are worming their way into prices. If producers start to pass on the kinds of increases that we saw in the PPI release it’s going to get a lot worse. Consumers are certainly feeling it and paring their spending, and in general feeling less sure of their economic prospects.

Important Data Points From The Past Week

U.S. Consumer Price Index (CPI)

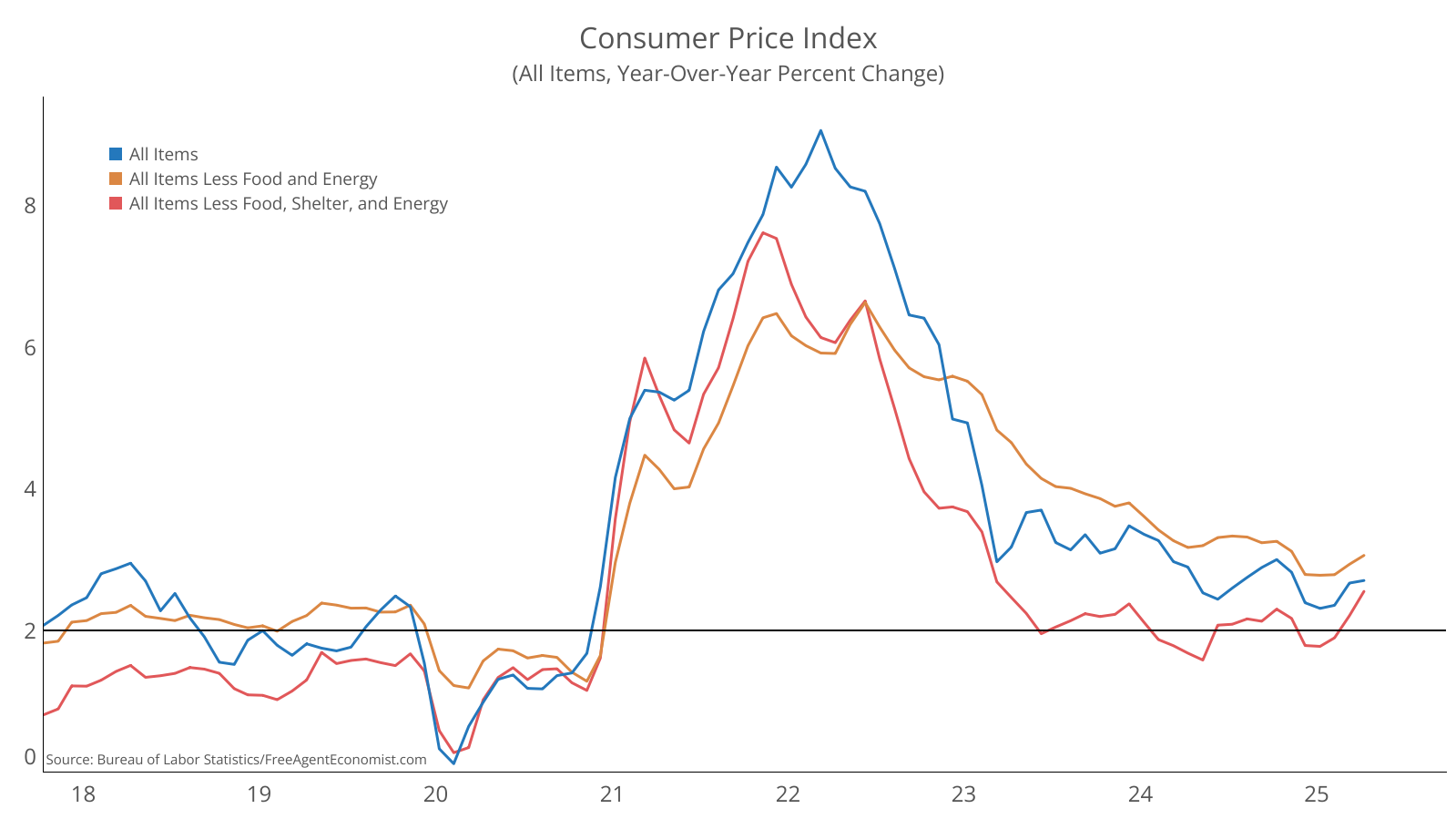

Consumer inflation accelerated in July. On a year-over-year basis, the headline number remained steady at 2.7%, but the core (less food and energy) measure rose from 2.9% to 3.1% and the super core (less food, energy, and shelter) shot up from 2.2% to 2.6%.

Interesting story here. Lower energy prices restrained overall inflation in the month, but shelter is the more interesting story. Much of the blame in the higher-than-expected inflation over the last several years has been shelter costs; and the narrative has been that once rents reset shelter costs would soften due to excess supply of rentals. That appeared to happen this month. So, the underlying measure of core goods and services moved considerably higher and likely is due to tariffs.

While this is not the Fed’s preferred measure it raises the stakes of cutting rates when they meet next in September. If the next jobs report is weak, their hands will be tied, and they cut. If it’s OK, rising inflation will make a potential cut less palatable.

Canadian Building Permits

Canadian building permits took a tumble in June, falling 9% to $12.0 billion. Nonresidential permits fell 15% in June mostly due to a decline in institutional activity in Ontario. Commercial permits were down slightly, while manufacturing permits rose led by activity in Quebec. Residential starts lost 4% in June with both single and multifamily activity declining.

Residential permits in Canada have been on a steady downhill run since their most recent peak in December 2024 reflecting uncertainty over how U.S. tariffs would impact the country. Nonresidential permits, meanwhile, have remained surprisingly steady but within the nonresidential space there has been much volatility in the underlying data no discernable areas of strength – or weakness – have appeared. The Canadian economy has been fairly resilient throughout the trade war, but one wonders how long they can keep it up.

U.S. Producer Price Index (PPI)

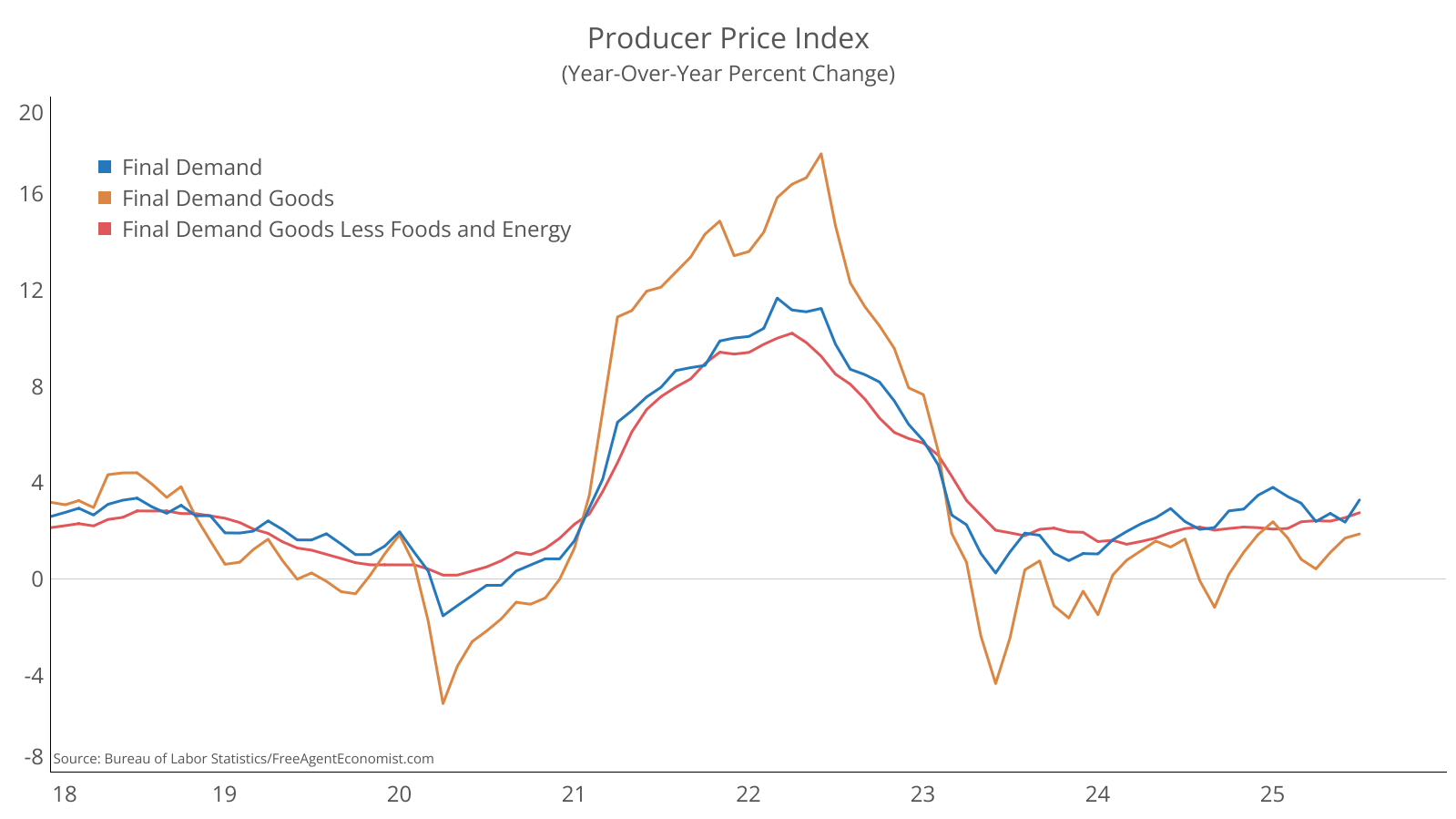

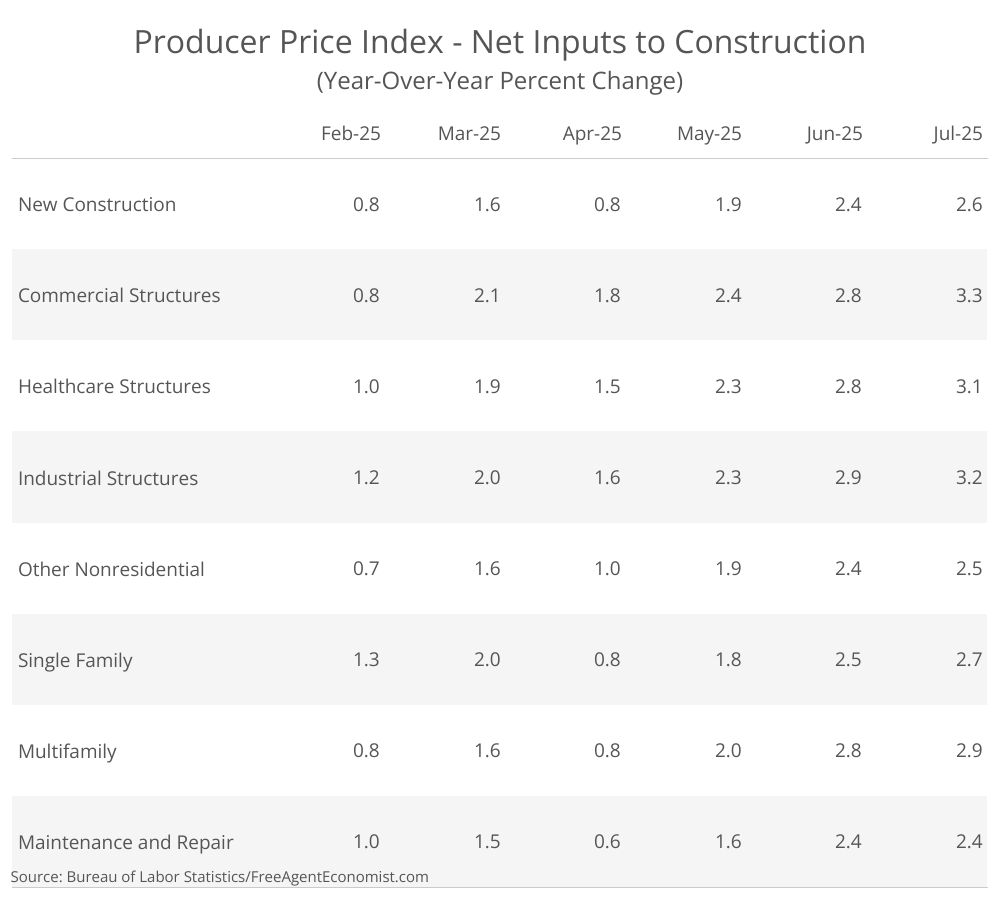

U.S. wholesale prices shot notably higher in July rising 0.9% from June … about 10% on an annualized basis. Clearly tariffs are working their way into the system. Looking deeper, food prices rose 1.4% in July, trade services jumped 2%, transportation and warehousing went up 1% and construction went up 0.6% (7% annualized).

Now bear in mind that these are prices that producers face. Whether they turn up in consumer prices depends on if a given producer is willing to eat the price increase or pass along the additional costs. If they do get passed along consumers will pull back, hiring will decline and so will economic growth.

If they don’t pass them along, firms will seek cost controls elsewhere and will likely hire less, which will slow consumer spending and thus economic growth.

It sort of feels like we’re on a one-way road here.

U.S. Retail Sales

U.S. retail sales inched higher in July, climbing 0.5% from June. Excluding food and auto purchases, retail sales were 0.3% higher. Looking at the detail, auto related purchases rose a solid 1.6% and nonstore (think online) sales were up 0.8%. On the downside, restaurant sales were down 0.4%, building material sales were 1% lower, and miscellaneous store sales were down 1.7%

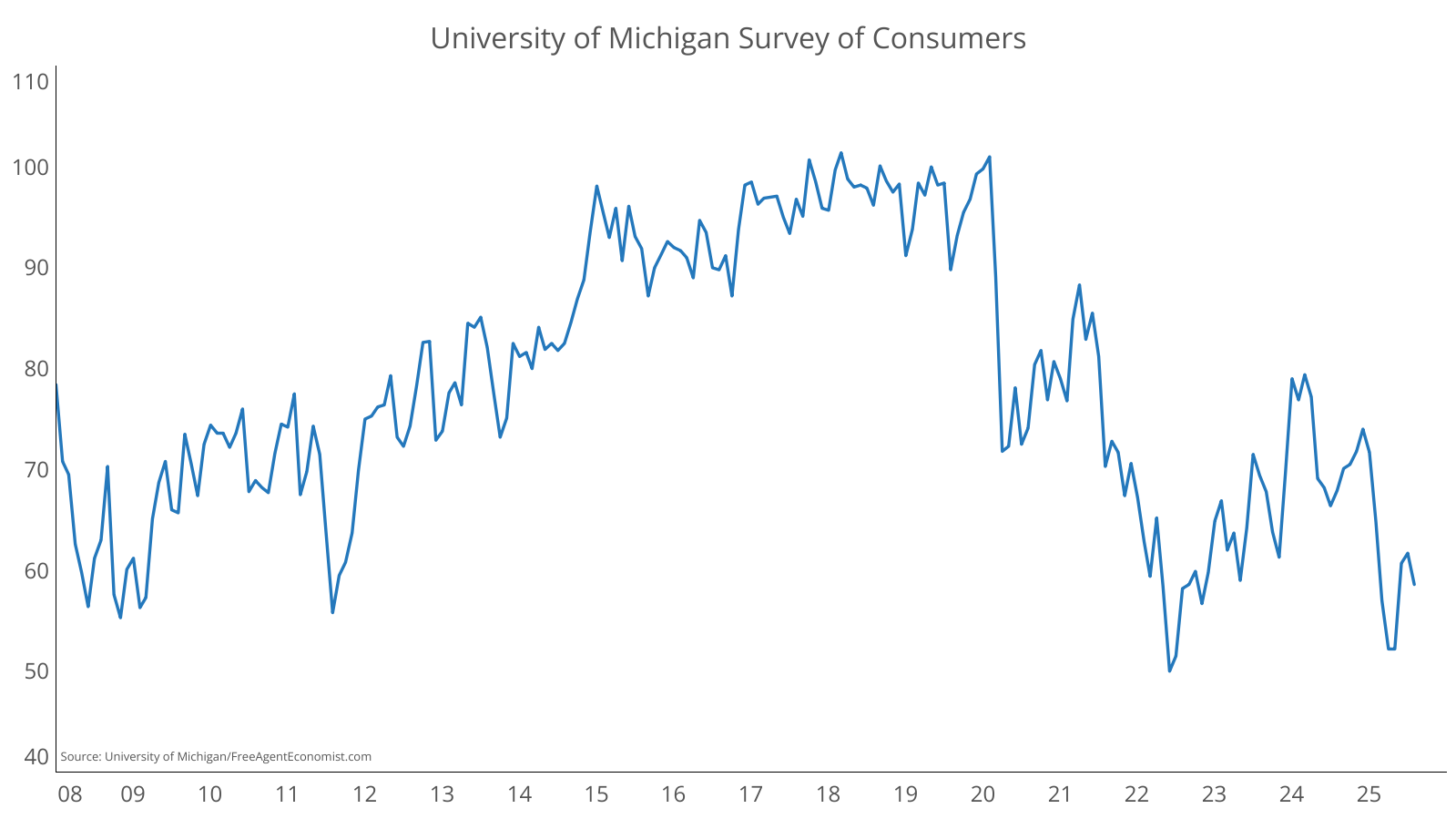

Retail sales were not robust by any sense of the word, but they at least were treading water and that’s a good thing, I think. Note though, that the dollars tracked in this series are nominal and don’t include inflationary impacts, so in real terms sales were likely flat to slightly down during the month. So once again, this puts the consumer squarely in the spotlight. They are pulling back on their spending, albeit in tepid fashion, but they are setting the stage for slower economic growth in Q3, especially with a retrenchment in consumer sentiment.

University of Michigan Consumer Sentiment

Consumer sentiment fell in August, dropping from 61.7 in July to 58.6. This is the first time consumer sentiment has declined in four months. The lower reading came down to current perceptions of the economy and comes on the heels of weaker job growth over the past couple of months and rising inflation. The expectations component fell as well. It’s going to be hard to maintain positive consumer momentum (and economic activity) if this persists.

What I’ll Be Watching This Week

In the U.S. we’ll see new residential construction starts and the FOMC meeting minutes. We’ll also get regional and state employment levels from the BLS. This could be interesting. This data is the little brother/sister of the jobs report that comes out on the first Friday of each month but given the timing of the release generally includes more responses – so it could give us an indication of how/if the main jobs number for July will be revised when we see the next release on September 5. Busy data week in Canada: consumer and industrial inflation data will be released along with retail sales.

What I Watched Last Week

This movie ells the true story of the theft of Goya’s portrait of the Duke of Wellington from the National Gallery in London in 1961. Has Helen Mirren ever made a bad movie??

How Can I Help?

I’m taking on a limited number of clients to help with bespoke analysis of the economy and construction and what it means for your company. I’m also available if you’re in need of a speaker at an event or someone to come talk to leadership groups on the state of the economy, demographics, real estate, and construction.

If you want to discuss either option, sign up for a spot on my calendar.

Do you know someone who would benefit from the information in this newsletter? Please share the sign up link with them.