Week of July 28

That Was Not A Good Week

As I stated in this space two weeks ago, this past week’s data would be a very good indicator of where the U.S. economy is headed.

What did we see? Second quarter GDP growth was anemic, inflation is starting to inch higher, the labor market is slowing, and construction is pulling back.

Tariffs were also in the news this week. There is some relief I suppose that the spate of deal announcements might lower the temperature (although tariffs under those agreements will be higher than before), but the lack of a deal with Canada and Mexico is very worrisome.

Perhaps most troubling was the firing of the BLS commissioner on Friday in the wake of the weak jobs report as the President questioned the quality of the data. To be clear, there is no evidence that the data is “cooked”. Indeed, through multiple administrations of both stripes in my nearly 30-year economics career I’ve (and most observers) believed in the purity of the data. Should that belief be undermined it could result in incorrect decisions by the businesses and even the Fed, resulting in a much worse economic outcome.

Recession inbound? I’m still saying no … for now.

Important Data Points From The Past Week

U.S. Gross Domestic Product

The U.S. economy expanded in the second quarter of the year, growing an annualized 3%. This follows the annualized 0.5% decline in Q1. All the swing between the first and second quarter was due to fluctuations in trade as businesses looked to get ahead of tariffs. On the plus side, consumer spending accelerated in the second quarter; however, business spending contracted.

If one were to remove trade from the equation, the U.S. economy would have expanded by an annualized 4% in the first quarter but contracted by 2% in the second. What’s the real story? The pullback in business spending reflects the concerns over high rates and tariffs and if this persists, it will lead to a further slowdown in hiring. Consumer spending remains the bright spot, and as I’ve indicated in the past if consumers spend the economy will stay afloat. The jobs report that came out later in the week highlighted that the labor market continues to throttle back. Economic growth will slow to a crawl in Q3.

Bank of Canada (BoC) Monetary Policy Annoucement

The Bank of Canada held the policy rate steady at 2.75% - the third time they’ve made this decision is as many months. This was not a surprising move. Inflation has ticked marginally higher, and the June employment number was stronger than anticipated. The statement noted that the economic situation remains worrisome and that “there may be a need for a reduction in the policy interest rate.”

Looking forward, the BoC is assuming that the economy will contract in the second quarter and that inflation will ease back. Assuming that occurs, we’ll see a rate cut in September.

FOMC Monetary Policy Announcement

The Fed also held their policy rate unchanged for the fifth consecutive meeting. This was not a unanimous decision though as two Governors dissented in favor of a 25 basis point cut. The timing of this meeting, just days before the July jobs report, is unfortunate. They have little justification for cutting rates over fear of an impending economic meltdown and the jobs report would have given a much more real-time assessment.

Where do they go from here? The next meeting is in mid-September so there will be two more jobs reports and two more inflation data points. I’d still put odds on a rate cut at that meeting and perhaps one or two more before the end of the year.

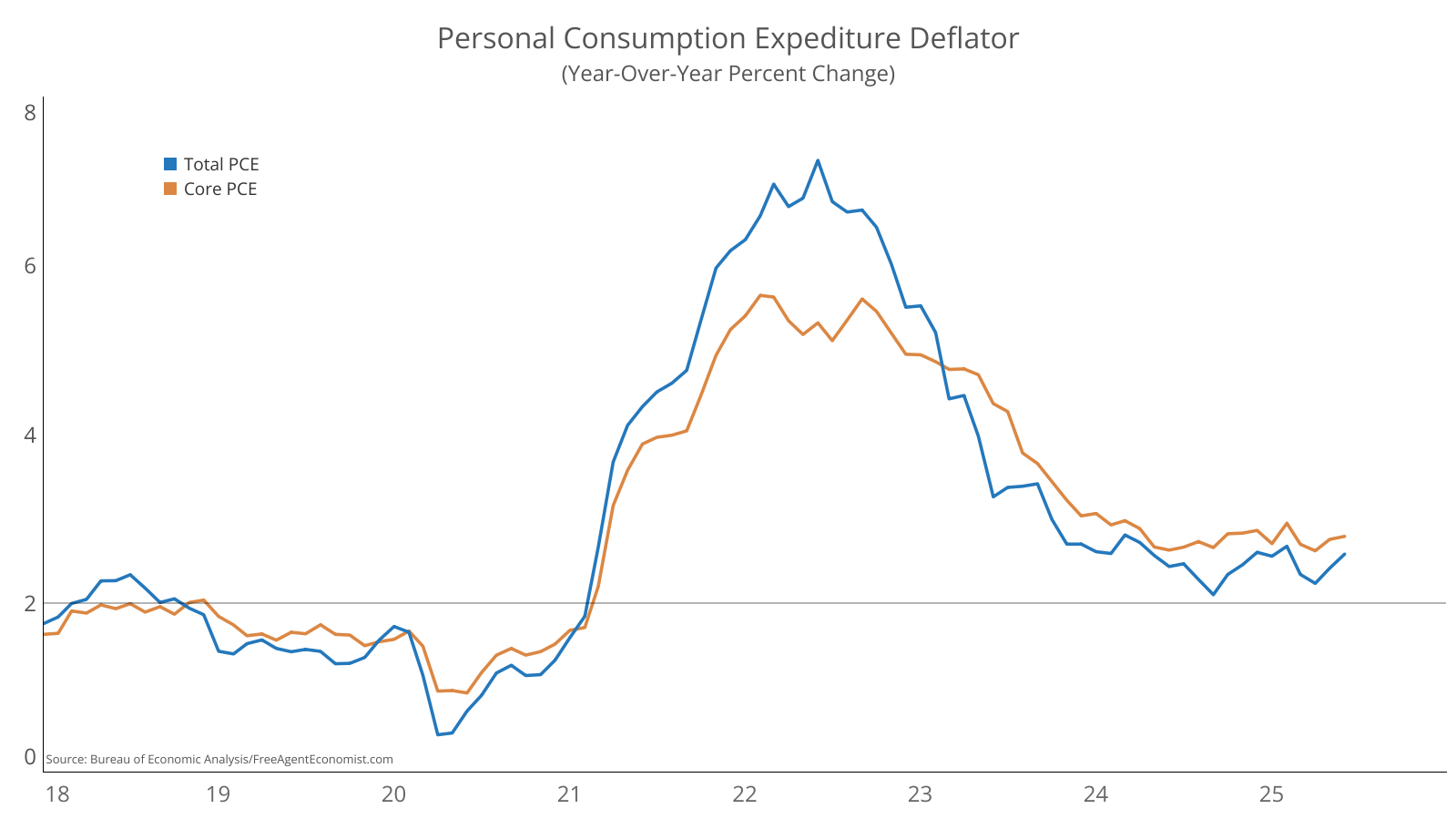

U.S. Personal Consumption Expenditure Deflator

The Fed’s preferred measure of inflation moved higher in June – the main number accelerated from 2.4% on a year-over-year basis to 2.6%, while the core measure stayed essentially the same at 2.7% over last year. The report also showed that when adjusted for inflation consumer spending is moribund.

Looking backwards to the Fed’s decision one can see that the Fed was right to hold the line on rates over the fear that tariff impacts are slowly making their way into consumer prices. However, the jobs report showed that the economy is slowing. What to do…what to do…

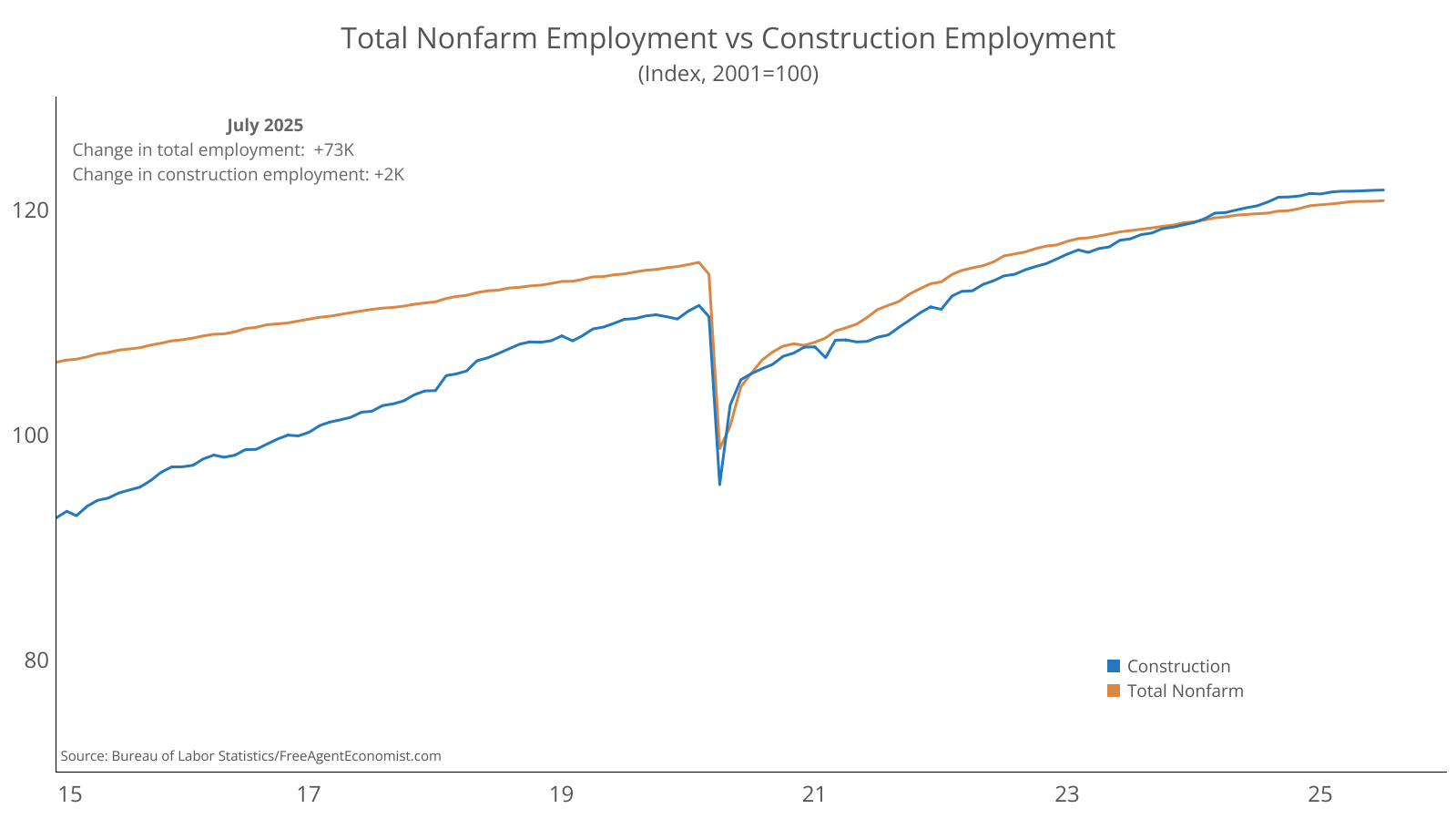

U.S. Jobs Report

The US economy added 73K new positions during the month and the unemployment rate remained at 4.2%. Construction added 2,000 new jobs. Once again though, the number was heavily biased towards healthcare which added 73K – so removing that and you’ll note that there was little additional growth in the labor market.

There’s no two ways about it. This was a bad report. In 2024 the economy added an average of 168K jobs per month. Through the first seven months of this year that average has slowed to 85K jobs/month and over the last three months the average has been 35K new jobs. Outside of a few pockets like healthcare there is very little positivity. It highlights the Fed’s difficult balance between supporting the economy and fighting inflation.

University of Michigan Consumer Sentiment

Consumer sentiment improved in July, rising from 60.7 to 61.7 over the month. It was a mixed bag though. The increase was due to a sizeable jump in how consumers feel about present economic conditions, while future expectations slipped back.

It’s clear that consumers have recalibrated after the tariff-induced declines earlier in the year. But (there’s always a but), they remain more troubled about what the situation will be like over the next few months. The jobs report will likely result in reduced sentiment over the next few months, which could lead to a retrenchment in consumer spending.

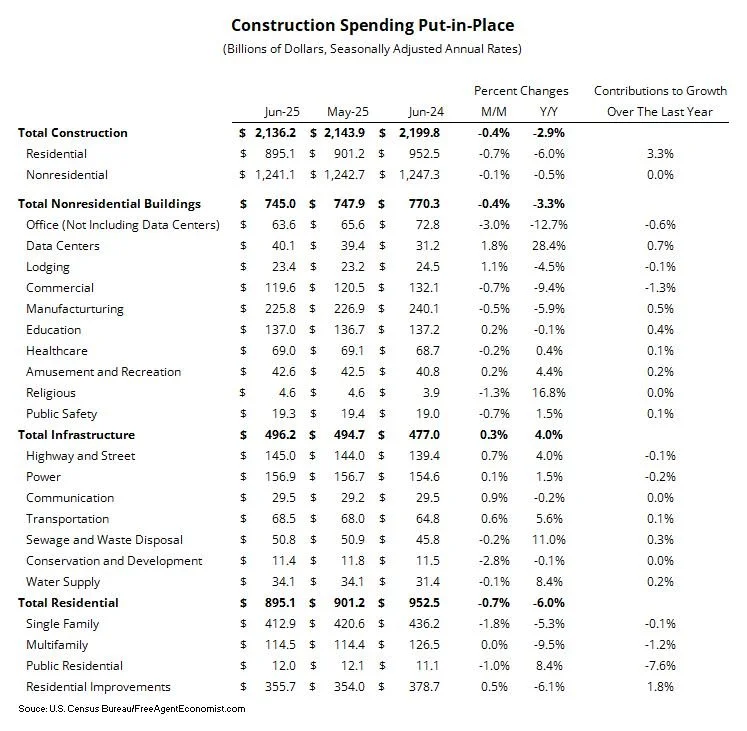

U.S. Construction Spending Put-in-Place

Construction spending fell in June, falling 0.4% from May. Residential spending lost 0.7% in the month due almost entirely to single family activity, while multifamily was flat and improvement increased.

On the nonresidential side, construction spending slipped 0.1% from May to June. Traditional office buildings and commercial structures were behind the decline, while data centers, lodging, education, and highway and street spending all moved higher.

I’ve spent some time over the last several months talking about how single family will continue to erode in the face of high rates, but that multifamily will show some life. I think this month’s data was further confirmation of that. There’s not much upside to the nonresidential space outside of data centers. Infrastructure will also be a strong point over the next year but expect weakness elsewhere. I’ve redone my forecasts considering the benchmark revisions of last month and now the full second quarter and I’ve lowered my 2025 forecast for total construction spending from a +4.3% to +3.0%.

What I’ll Be Watching This Week

Thankfully a quiet data week in the U.S. – factory orders, vehicle sales and the Bank Lending Officer Survey. We’ll get the Canadian jobs report on Friday.

What I Watched Last Week

A nerdy CIA cryptologist goes rogue to avenge his wife’s death. This stars Rami Malek, and while I have trouble not seeing him as Freddie Mercury this was a good Friday night flick!

How Can I Help?

I’m taking on a limited number of clients to help with bespoke analysis of the economy and construction and what it means for your company. I’m also available if you’re in need of a speaker at an event or someone to come talk to leadership groups on the state of the economy, demographics, real estate, and construction.

If you want to discuss either option, sign up for a spot on my calendar.

Do you know someone who would benefit from the information in this newsletter? Please share the sign up link with them.