Week of July 14

Status Quo

All in the data this week was not surprising. The early impact of tariffs is starting to bleed into consumer prices, consumer spending and their mood, improved while single family housing fell further.

This week did nothing to change my outlook for the economy. The U.S. economy will slowly decelerate over the coming months but will avoid recession. For their part the Fed will cut rates in September, October, and December due to rising unemployment.

Important Data Points From The Past Week

U.S. Consumer Price Index (CPI)

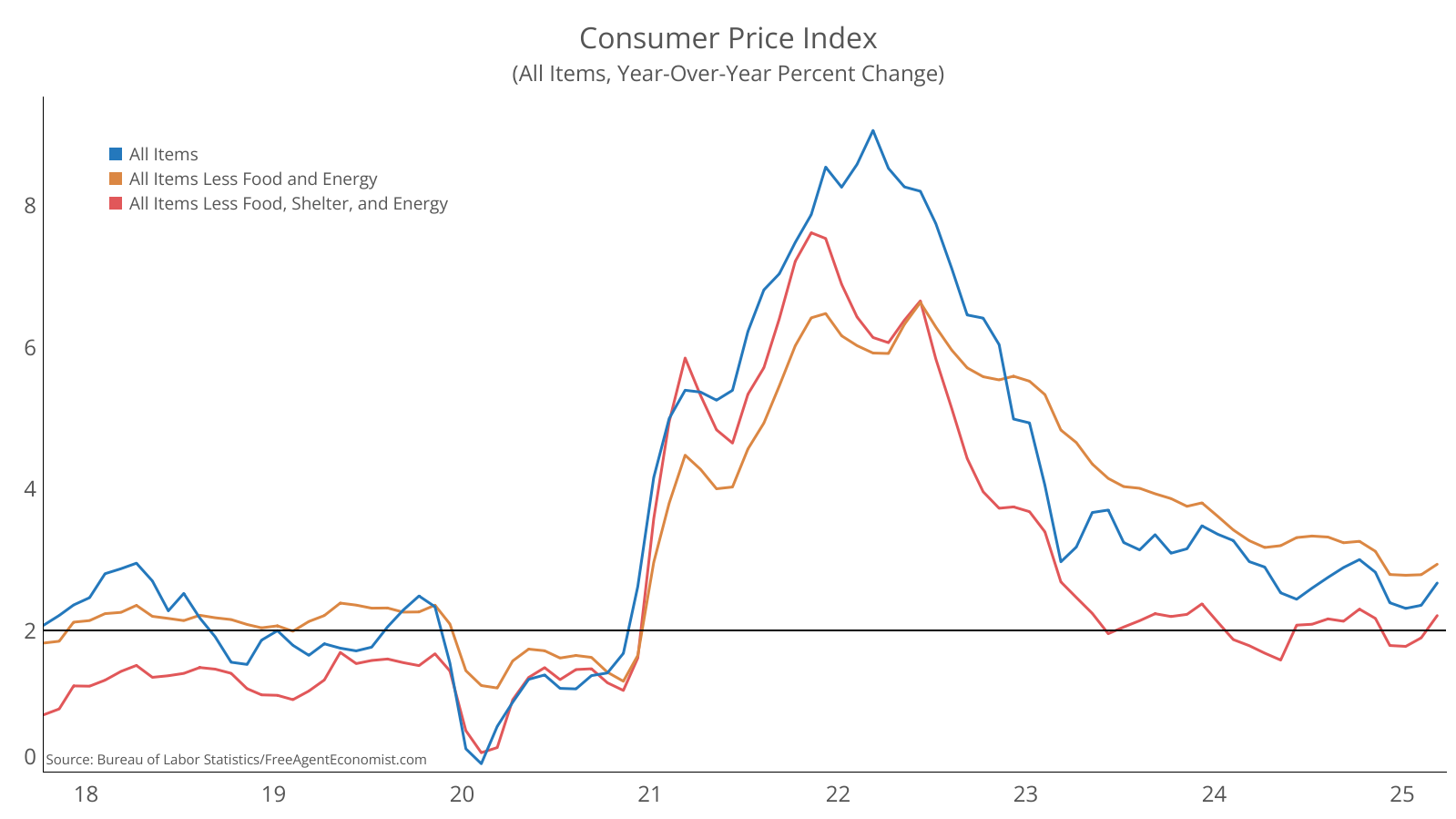

U.S. consumer inflation accelerated in June to 2.7% on a year-over-year basis, up from the 2.4% pace in May. Core inflation (excluding food and energy) and the “super-core” (excluding food, energy, and shelter) also picked up speed to 2.9% and 2.2% respectively on a year-over-year basis.

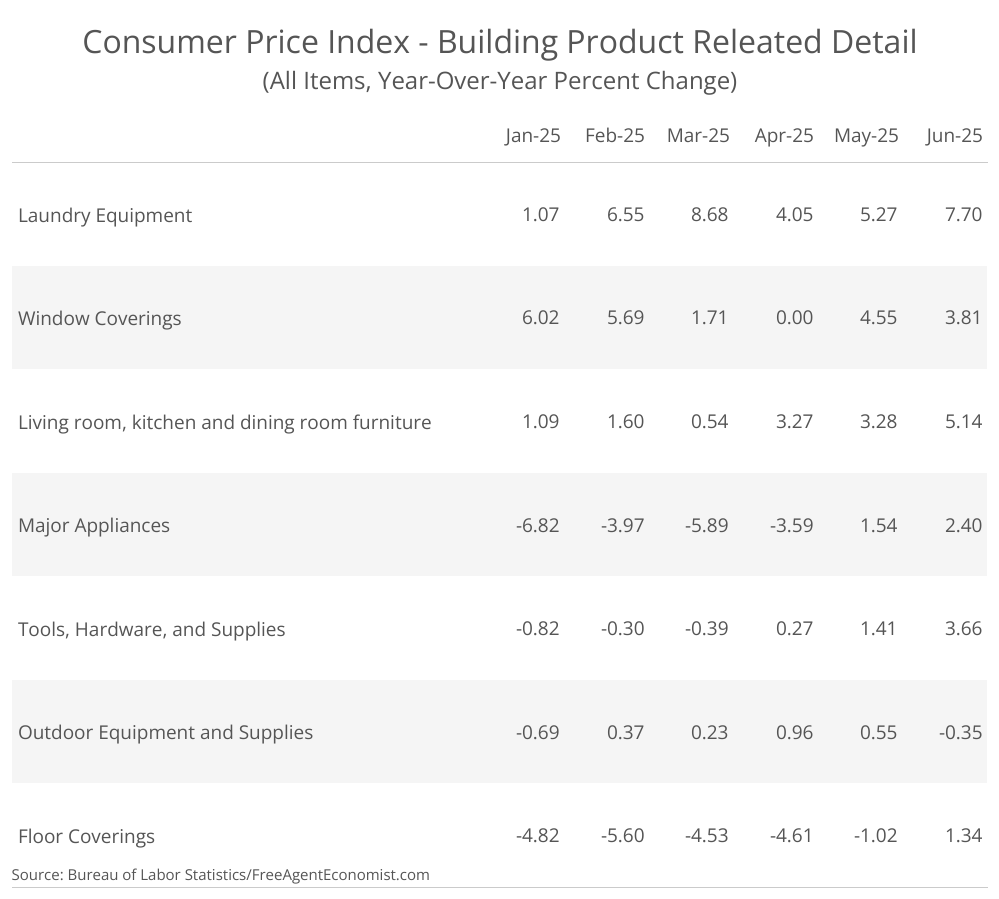

The underlying question with this acceleration is how much of this is tariff related? It’s clear that inflation picked up pace in some sensitive categories like household goods, appliances, tools, and food. But I think this is just the beginning. The new orders data, and the first quarter import figures in GDP are very suggestive of a massive amount of preordering before tariffs were implemented and given the slow pace of economic growth those bloated inventories will take time to be depleted. The takeaway is that the overall impact on inflation will be lagged. So this very well might have been the first wave, but there are surely more to follow. This means no change in my thinking of the Fed holding rates steady until September.

Canada Consumer Price Index (CPI)

There was a similar trend in Canada with consumer inflation heating up there as well. On a year-over-year basis, consumer prices are up 1.9% from a year ago, while the core measure accelerated to 2.6% in June. There were, though, some cross currents in the underlying data – food, energy, shelter all show a slight deceleration. However, rent (which has a high weighting in the basket of goods accelerated as did clothing and automobile prices.

Inflation is likely to be very sticky in Canada, given the lagged impact of shelter prices (both rent and owned) and should result in the Bank of Canada holding firm and not cutting rates when they next meet at the end of the month.

U.S. Producer Price Index (PPI)

Counter to the CPI inflation data, any tariff impact on producer prices appears to be muted. The PPI for final demand slowed from 2.7% on a year-over-year basis to 2.3%. However, there was a decent pickup in final demand goods, which is now at 1.7% on a year-over-year basis in June; up from 1.1% in May.

Looking a litter deeper into the construction related data and the tariff impact is much clearer. On a year-over-year basis, the PPI for new construction has accelerated sharply since February, and that acceleration has been widespread across most types of construction. This will certainly continue to be a sizable headwind for construction activity in the second half of the year.

U.S. Retail Sales

June was a good month for retail sales, which rose 0.6% from a rather dour May. Even stripping out gas, autos, and building materials sales were up 0.5% which highlights the broad-based strength across the month. In truth, the only down markets were furniture and electronics, which are relatively small categories.

It goes to show why I don’t think the US is 100% headed for recession – the consumer continues to spend. I still think consumers are slated to pare their spending in the months to come as tariffs get fully baked into prices and the labor market slows, but at least for now economic prospects are looking OK

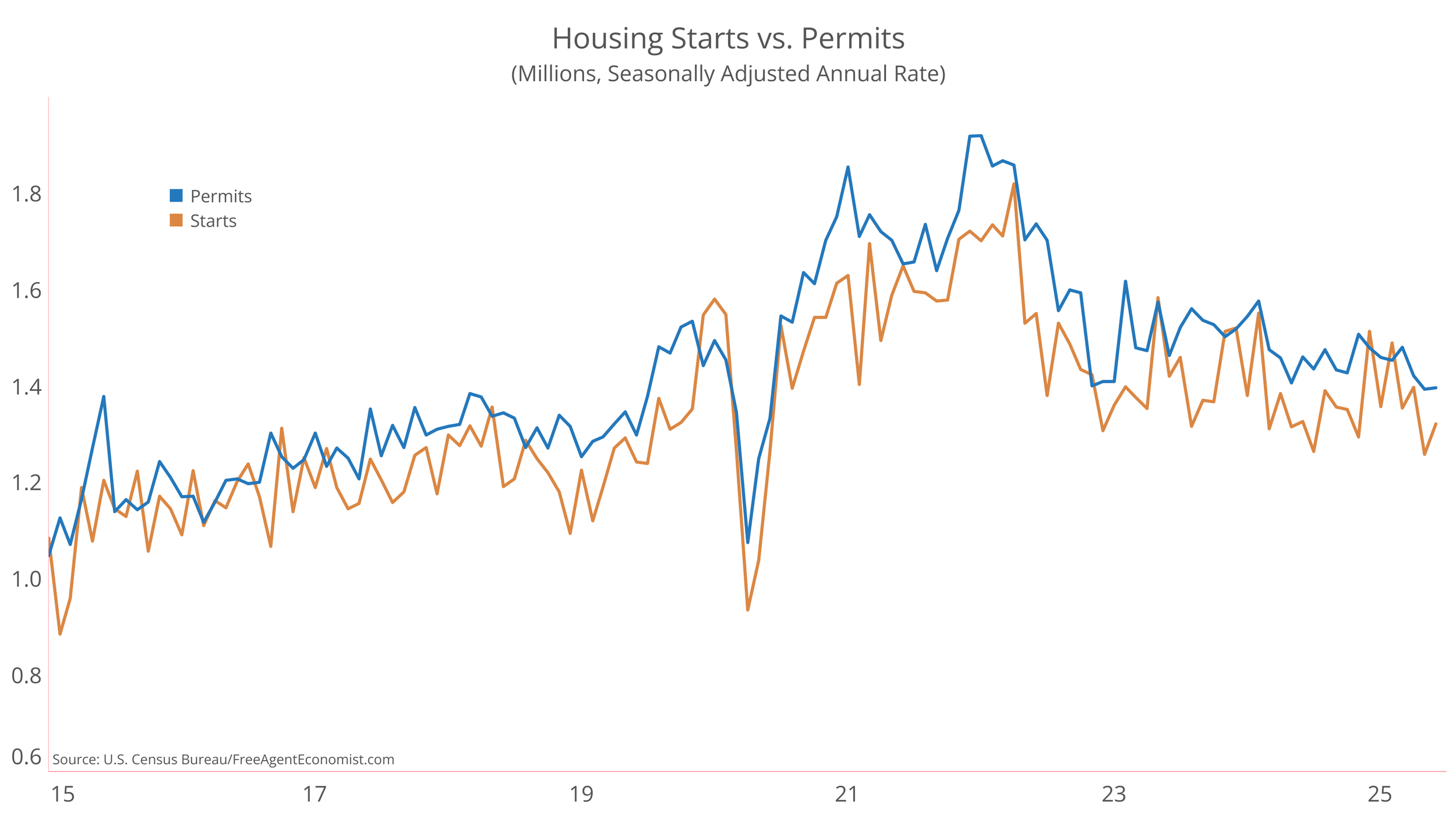

U.S. Housing Starts

Housing starts posted a solid gain in June, rising 4.6% over the previous month on a seasonally adjusted annual rate basis. Not surprisingly, single family starts were down 5%, while multifamily starts rose 31%. Permits eked out a small gain, rising just under 1% for the month. Single family permits were flat relative to the previous month, while multifamily permits rose 2%.

The single family market continues to be hamstrung by general economic malaise, high interest rates, and prices. But, and I feel I’m the only one standing on the mountaintop screaming this, multifamily developers seem ready to jump into the breach and build to take advantage of the lack of units available. Detractors continue to point to the vacancy rates and how high they are as a sign that the market isn’t ready for growth. But one just needs to follow the demographic shifts to see that those vacant units are not where people are or want to live. No change to my housing starts forecasts based on this month, but another solid month for multifamily and I’ll have to boost that outlook.

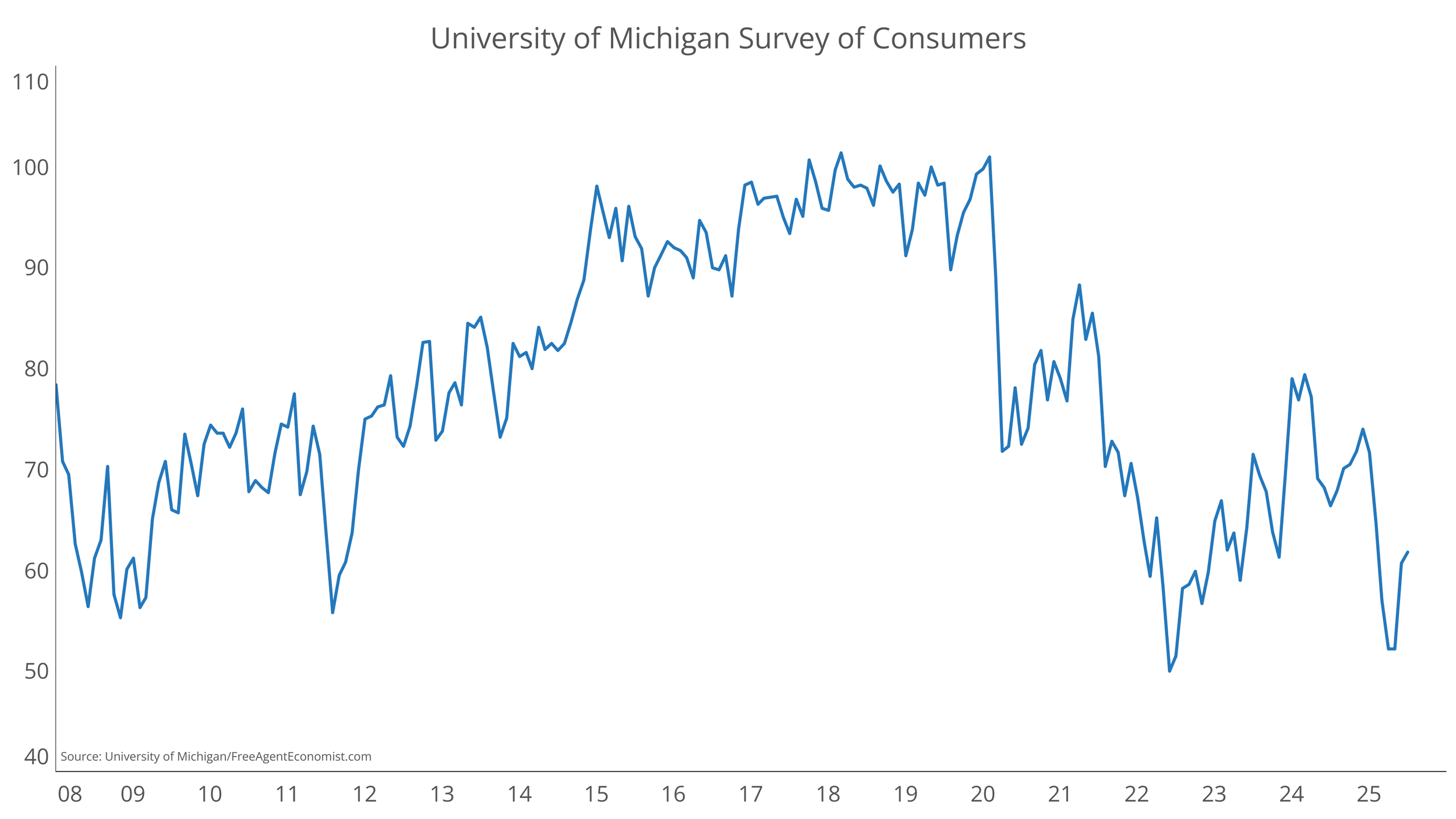

University of Michigan Consumer Sentiment

Consumer sentiment rose in July, to 61.8 from 60.7 and is now at its highest level in five months. Most of the gain was due to consumer’s perception of current conditions while their forward-looking expectations were little changed. Not surprising given that we still haven’t seen tariffs fully baked into prices. From a broader macroeconomic outlook, this is certainly positive. If consumers feel good, they won’t fully pullback on spending and will provide a floor on economic growth over the next few months.

What I’ll Be Watching This Week

In the U.S. we’ll see data on new home sales and durable goods orders, while in Canada there will be data on industrial prices and retail sales.

What I Watched Last Week

I am of the age where I remember sitting in front of the T.V. with my friends watching the entire day play out. U2, Queen, The Who, and David Bowie were all highlights for me. The concert raised $150 million for famine relief in Africa (just under half a billion in today’s dollars) and was my generation’s Woodstock.

How Can I Help?

I’m taking on a limited number of clients to help with bespoke analysis of the economy and construction and what it means for your company. I’m also available if you’re in need of a speaker at an event or someone to come talk to leadership groups on the state of the economy, demographics, real estate, and construction.

If you want to discuss either option, sign up for a spot on my calendar.

Do you know someone who would benefit from the information in this newsletter? Please share the sign up link with them.