Week of July 7

Just When You Thought It Was Safe To Talk Trade

I remember thinking a couple of weeks ago that I was pleased that the rhetoric over trade and tariffs seemed to be cooling off. Discussions were moving forward with countries and there seemed to be some desire both in the Administration as well as with foreign leaders to talk it out and find common ground to avoid a crippling trade war.

That seemed to go the way of the dodo this week with copper and then additional threats on Canada, Mexico, the E.U. and Brazil. As long as this Sword of Damocles hangs over the heads of businesses and consumers confidence, hiring, and investments will be subdued. And the longer it persists the higher the potential for recession.

Important Data Points From The Past Week

FOMC Meeting Minutes

The FOMC minutes from their Jun 17-18 meeting were as expected - that is they reinforced their desire to be patient in lowering rates given the “considerable uncertainty”. What I found interesting, though, was this little tidbit on how the committee views tariffs flowing through to prices and inflation, “While a few participants noted that tariffs would lead to a one-time increase in prices and would not affect longer-term inflation expectations, most participants noted the risk that tariffs could have more persistent effects on inflation.” So, like most of us they seem to be struggling to understand the ultimate impact.

Of course, this becomes more important as the President this week went back on the tariff attack, most notably on copper and Canada. So, the risk of inflation remains high, but the eroding labor market tightens the vice. I still think they hold rates steady in July than cut in September.

Canadian Building Permits

Canadian building permits rose 12% from April to May to $13.1 billion. Residential permits were up 2%, with much of the strength centered around multifamily activity in British Columbia while institutional activity in Ontario drove a 26% increase in nonresidential permits over the month.

I don’t want to take away what was a good month for building intentions in Canada. The stability and opportunity in the public facing sector should help the Canadian construction market keep its head above water as the economy slows. But significant risk remains for the residential and commercial space – especially with new tariffs on cooper and the threat of rising tariffs on other goods.

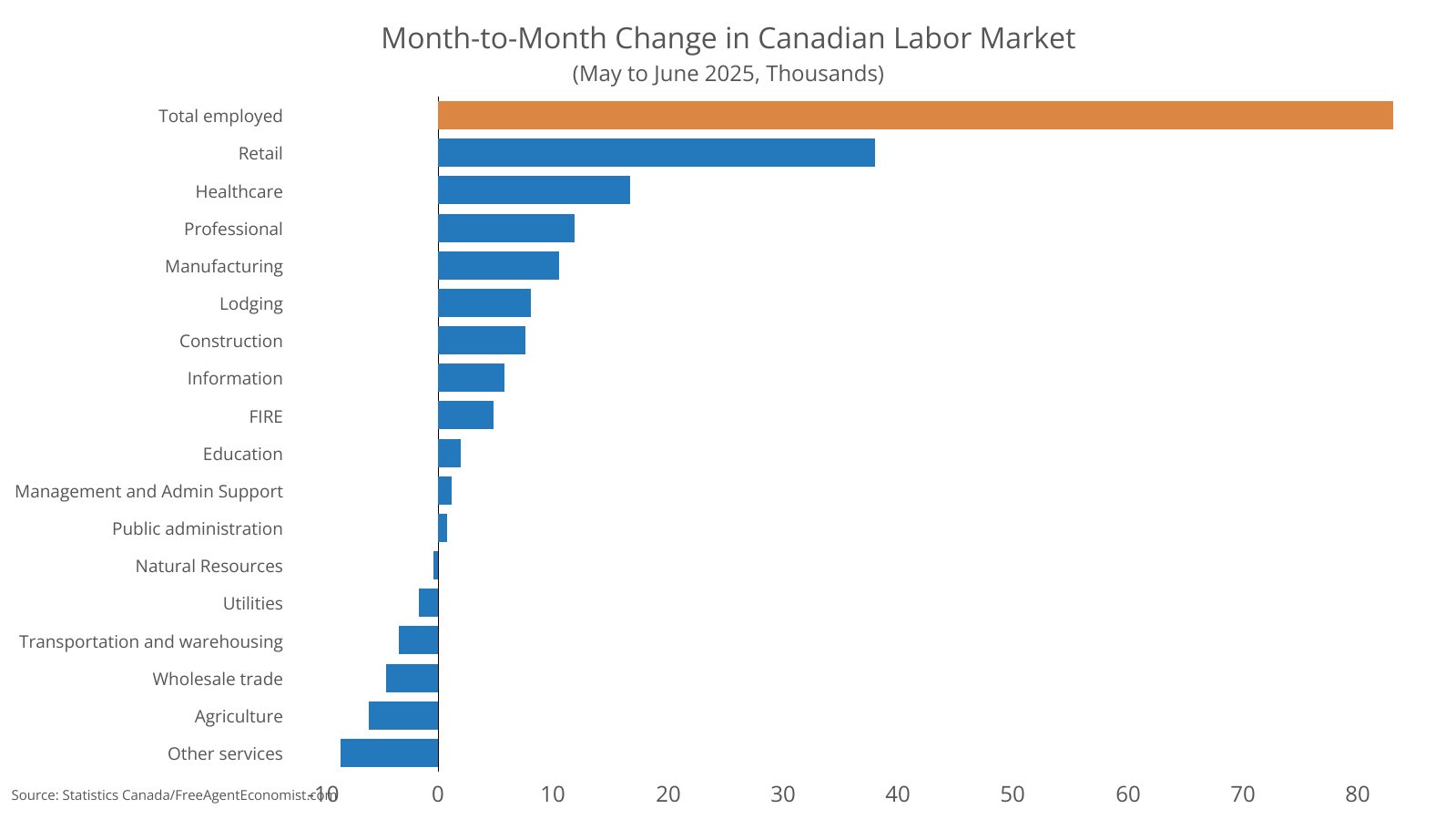

Canadian Employment Report

The Canadian economy added a stunning 83K jobs in May – the first such gain since January. Just about half of the jobs added were in retail, but healthcare added a decent chunk as well. Construction jobs rose by 7.6K.

OK, so naysayers would say that much of the gain this month was in part time work, which doesn’t tend to say great things about the state of the economy. But, given the threats to the Canadian economy right now a gain is a gain so this report should be viewed in a very positive light. Does it mean that the Canadian economy is out of the woods? Hard no, but at least for now we can breathe a little easier. This also lets the Bank of Canada keep its powder dry on rates should conditions worsen.

What I’ll Be Watching This Week

Busy week in the U.S. – two inflation data points, industrial production, retail sales, residential starts, and consumer confidence. In Canada we’ll see an inflation read on Tuesday.

What I Watched Last Week

I remember seeing Jaws when I was probably about 9 or 10 in the lates 70s. It was part of a double feature at the drive-in, and I went with my parents. Not sure if that was the best parenting decision ever, because it scared me senseless. The music, the fact that you really don’t see the shark for some time in the movie, and the posters were all intense. It’s still one of my favorite movies and to this day whenever I’m in a boat I think about what the hell is down there that’s going to try and eat me.

How Can I Help?

I’m taking on a limited number of clients to help with bespoke analysis of the economy and construction and what it means for your company. I’m also available if you’re in need of a speaker at an event or someone to come talk to leadership groups on the state of the economy, demographics, real estate, and construction.

If you want to discuss either option, sign up for a spot on my calendar.

Do you know someone who would benefit from the information in this newsletter? Please share the sign up link with them.