Week of June 30

A Noticeable Slowdown

Another week of less than stellar data. Construction activity slipped back, and the jobs numbers outside of education and healthcare showed that the labor market is throttling back.

The next couple of months will be critical for the economy. The trend towards lower inflation has stalled and indeed may head higher as soon as the cheaper stock of inventory is sold off and the labor market is slowing. Still no signs of impending recession, but it’s a far from positive outlook.

I’m really excited to once again be presenting at the ENR 2025 Midyear Construction Forecast on July 17th at 2pm alongside Ken Simonson and Anirban Basu. There’s a lot to talk about so I hope you tune in – you can register here.

Important Data Points From The Past Week

Construction Spending Put-in-Place

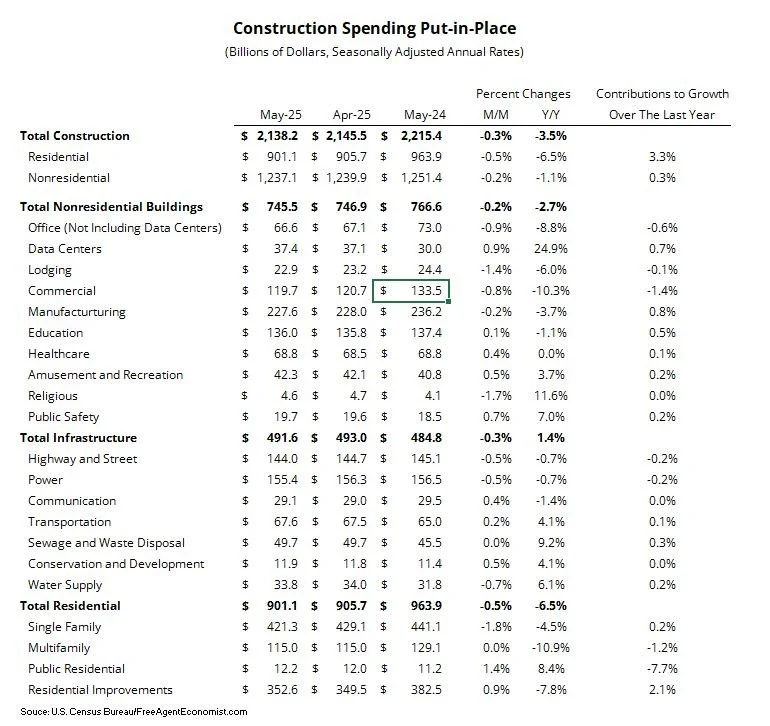

Construction spending put in place (PiP) lost 0.3% from April to May, falling to $2.1 billion on a seasonally adjusted annual rate basis. Nonresidential spending fell 0.2%, while residential lost 0.5%. On a 12-month rolling sum basis, total spending is up 4%, with residential up 4% and nonresidential up 1%.

There was little positive to find in this month’s report; however, data center, heathcare, amusement, education, and residential improvement spending all showed respectable improvements. On the other side though, traditional office, lodging, commercial, single family, and highway and street spending were all down.

Construction spending will continue to throttle back. The starts data on which the PiP numbers are based have been moving sideways and there is enough evidence out there that developers and owners are pausing/delaying and in some cases cancelling projects due to economic uncertainty. The release this month also brought with it significant revisions to the historical data, so my forecasts will need to be slightly retooled over the coming month, but I think the overall tone will remain the same.

U.S. New Light Vehicle Sales

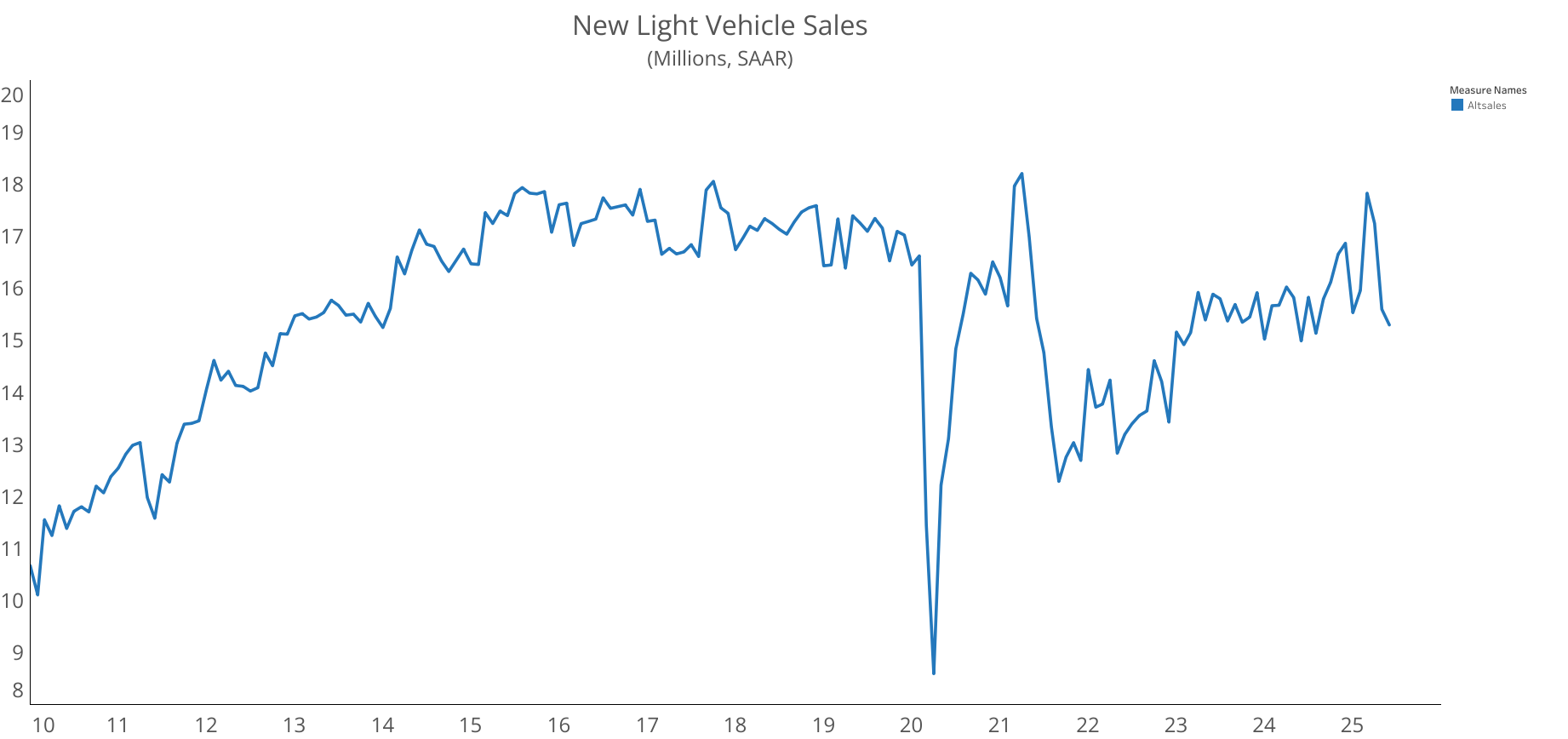

Light vehicle sales fell for the second consecutive month in June, which is in line with the strong Q1 performance that was likely fed by tariff fears. Vehicle sales will continue to fall in the coming months in response to the stronger earlier months, but also due to the general malaise in the economy, high vehicle prices and elevated rates.

U.S. Employment Report

The headline jobs number looked decent, with the U.S. economy adding 147K jobs in June. But half of that were government jobs (state and local education to be exact) – so really, private employment rose by 74K jobs, down from the 137K private jobs added in May. Digging deeper, healthcare added 58K of that 74K, so what we have is a clear sign of significant slowing in the labor market. The unemployment rate fell to 4.1%, but that was due to a decline in the labor force (i.e. the number of people looking for work).

Construction did buck the trend, adding just under 15K jobs – most of that in residential and nonresidential specialty trades. Jobs in the residential and nonresidential buildings and heavy and civil were all down in the month.

What I’ll Be Watching This Week

A very quiet data week in the U.S. with the only release of note being the FOMC meeting minutes. In Canada, we’ll see an update on the labor market and building permits.

What I Watched Last Week

I like origin stories (ok, the Han Solo movies was terrible), and this show tracing the roots of the iconic Captain Nemo and his submarine Nautilus is pretty good. Think swashbuckling pirate adventure crossed with some sci-f/steampunk action.

How Can I Help?

I’m taking on a limited number of clients to help with bespoke analysis of the economy and construction and what it means for your company. I’m also available if you’re in need of a speaker at an event or someone to come talk to leadership groups on the state of the economy, demographics, real estate, and construction.

If you want to discuss either option, sign up for a spot on my calendar.

Do you know someone who would benefit from the information in this newsletter? Please share the sign up link with them.