Week of June 9

No News Is Good News

For those expecting to see a rise in inflation due to tariffs (and that would be most of us) last week’s data left us scratching our heads. There was some rumbling in the nerd world that the budget cuts at the BLS (which puts together both the CPI and PPI data) is impacting quality and leading to more imputed (and less accurate) data, but I’m not sure I see that … yet.

It’s also far too soon to say that we overestimated the impact of tariffs on inflation. It could be that enough time hasn’t passed since tariffs took hold. Either way, the FOMC is going to look past the soft data last week and hold the Fed Funds rate steady.

Important Data Points From The Past Week

U.S. Consumer Price Index (CPI)

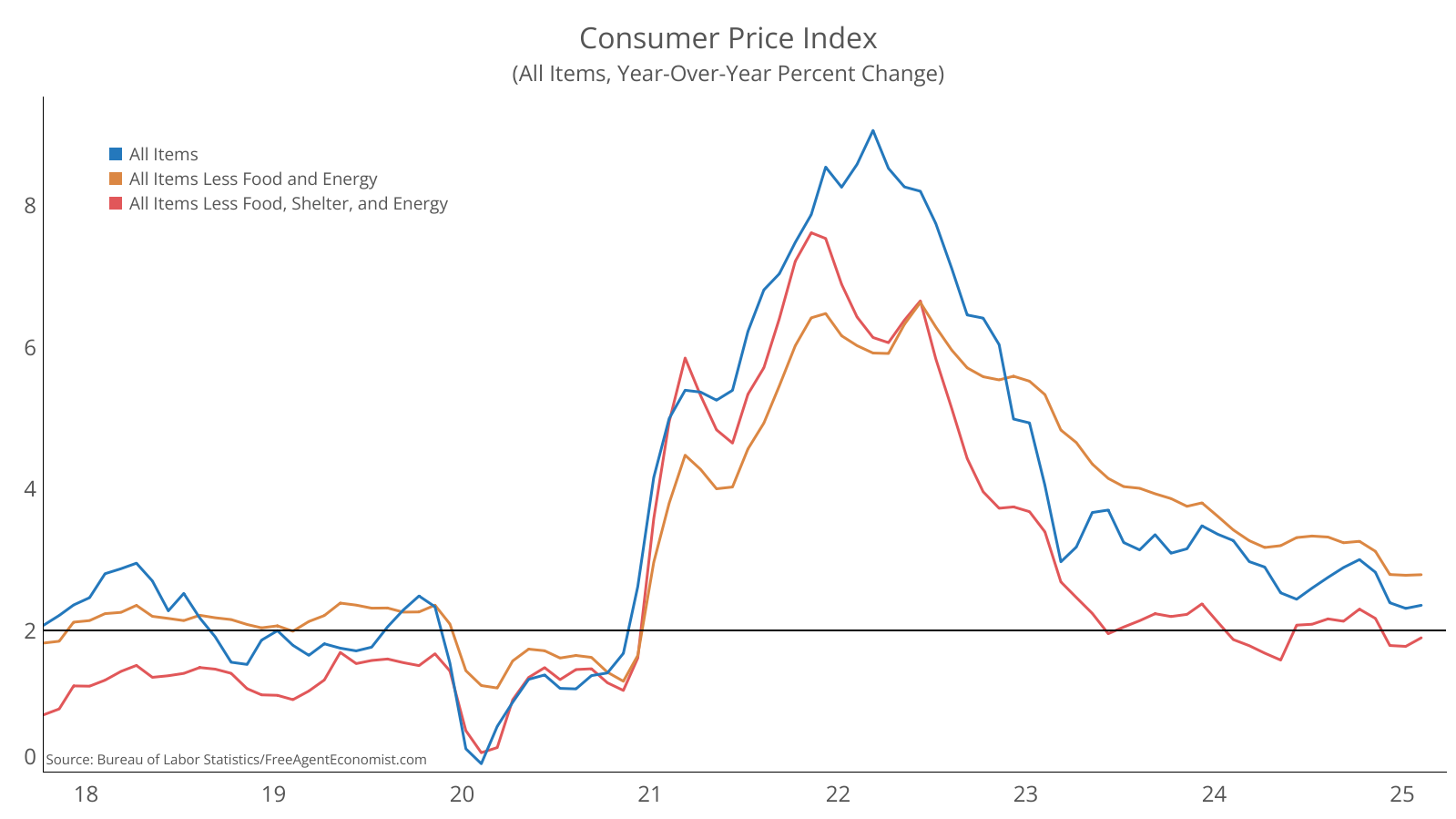

May’s read on consumer inflation was good news, with the CPI coming in cooler than expected. To be clear, core and super-core both accelerated on a year-over-year basis in May, but tariffs were expected to make this acceleration starker than it was. The headline number was essentially flat at 2.8% from a year ago.

From a building product perspective, most prices did accelerate, with window coverings and major appliances feeling the most pain. From this group I think appliance prices will take the brunt of tariffs and prices should continue to rise.

The question to ask, I think, is does this give the FOMC room to cut rates next week? I don’t think they cut. Yes, inflation is softer than anticipated and the labor market is cooling. But I don’t think the data is firmly trending that way yet – especially inflation. However, if the numbers continue to move in this direction, I think they will cut in July.

Canadian Building Permits

Canadian building permits plummeted in April, falling 7% from March. Residential permits were lower thanks to multifamily, while nonresidential permits rose. From a geographic perspective, British Columbia led the charge lower. Surprisingly though, building permits in Ontario increased.

This data is notoriously volatile, so I don’t know if I’d hang my hat on that steep of a decline persisting; especially given its geographic focus on B.C. Don’t get me wrong, Canadian permit activity will noticeably slow as the year goes on, but I think that it won’t be as dramatic as the April numbers suggest.

U.S. Producer Price Index (PPI)

Like the consumer inflation data, the tariff impact on May’s PPI was also largely muted. Final Demand prices accelerated to 2.6% on a year-over-year basis (up from 2.5% in April), while the core read (less food and energy) was essentially flat.

Where there was a sharp acceleration, though, was in the construction-related measures. This isn’t surprising considering the weight that imports have in either raw or finished construction products. May’s producer inflation data will not impact the FOMC’s decision making process one way or the other, but it’s another sign that the construction sector will be deeply impacted by the administration’s trade policy.

University of Michigan Survey of Consumers

Consumer sentiment shot higher in June, moving 16% higher than May. The gain in June was seen in both the current and expectations components of the Index and came on the heel of the cease fire in the trade war with China. Up until last week I would have said that consumer sentiment should continue to stabilize as the administration makes progress on trade deals; however, Israel’s attack on Iran brings geopolitical risks back to the forefront. If this conflict escalates, consumer sentiment will certainly tumble.

What I’ll Be Watching This Week

In the U.S. retail sales, housing starts, and the Conference Board’s leading indicator will all be released in addition to the FOMC meeting. In Canada, we’ll see data for retail sales and industrial prices.

What I Listened To Last Week

I felt the passing of Brian Wilson. I was fortunate enough to see the Beach Boys live three times – all in the late 80s. Dennis Wilson had passed by then, and Brian wasn’t on the road, but the core group of Mike Love, Al Jardine, Carl Wilson, and Bruce Johnston were all there. Music can be transformative and can take you to a different place, and for me The Beach Boys do just that, taking me back to those summer outdoor concerts with my friends. I know the cool kids would point out Pet Sounds as the quintessential Brian Wilson opus, and they aren’t wrong. But for me it’s the simplicity of this compilation album.

If you’re looking for another Beach Boy album, listen to Live In London from 1971. Again, no Brian but the harmonies on “California Girls” and the deep cuts like “Aren’t You Glad” and “Their Hearts Were Full of Spring” are pretty magical. Oh, and “God Only Knows.” Wow.

How Can I Help?

I’m taking on a limited number of clients to help with bespoke analysis of the economy and construction and what it means for your company. I’m also available if you’re in need of a speaker at an event or someone to come talk to leadership groups on the state of the economy, demographics, real estate, and construction.

If you want to discuss either option, sign up for a spot on my calendar.

Do you know someone who would benefit from the information in this newsletter? Please share the sign up link with them.