Week of June 2

Shaken, But Not Stirred

The data last week was stable, highlighting that the U.S. economy continues to downshift in an orderly fashion due to the impact of tariffs on the economy. This easing will continue as long as trade policy continues to create uncertainty in the minds of consumers and businesses. The additional back-and-forth on federal spending legislation and the debt ceiling, which is expected to be hit in August, is adding to the confusion. The risk of recession remains uncomfortably high.

Important Data Points From The Past Week

U.S. Construction Spending

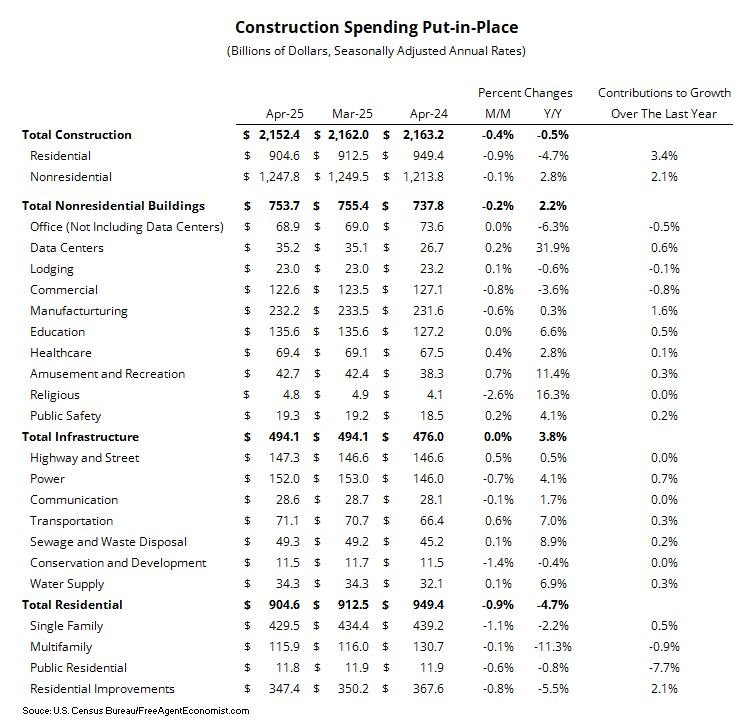

Construction spending put-in-place ticked lower in April, falling 0.4% from March. On a year-over-year basis, spending was down 0.5%. Nonresidential spending was down 0.1% in the month, driven lower by commercial, manufacturing, and power spending. Residential spending was 0.9% lower due to a sharp pullback in single family.

Since the construction spending tracks projects as they move forward from start to completion any tariff impact will be lagged. The one exception to that would be in the single family sector where the lag to completion is much shorter – so the decline this month is very likely due to tariffs – especially on lumber. The easing in nonresidential spending, I think, reflects more of a wait-and-see attitude in that projects are still being completed, but fewer are coming into to the start stage. That means construction spending will ease even further over the next 6 months or so. The forecasts I created back in January are still holding firm based on the data through April.

The BoC held their benchmark rate steady at 2.75% after also skipping a rate cut back in March. The justification is simple enough; the Canadian economy has yet to completely buckle from the trade war and the Bank wants to keep their powder dry in case more aggressive action is needed down the road. I think they stay on the sideline until such a time that the cracks in the foundation of growth become hard to ignore. Assuming current tariffs stay in place that’s likely to occur by late summer.

U.S. New Light Vehicle Sales

New light vehicle sales hit the brakes in May, dropping from an annualized 17.3 million units in April to an annualized 15.7 million units. This represents the largest drop in the series in about five years.

Consumers, wary of the impact of tariffs, increased their spending over the last few months. However, tariffs and concern over the long-term health of the economy has resulted in a sizable pullback. With the odds of recession still high consumers are likely to continue to refrain from big ticket spending – auto sales will continue to fall.

U.S. Jobs Report

The U.S. labor market continues to gradually downshift, adding 139K new jobs in May following the addition of 147K in April (revised down from 177K). The unemployment rate remained steady at 4.2%. For its part, construction added 4K new jobs, lower than the 7K jobs added in April.

Digging deeper in the construction numbers, growth was even across residential and nonresidential building, heavy and civil, and nonresidential specialty trade contractors, with each adding about 3 to 4K jobs. A major downshift though in residential specialty trade contractors, which shed 11K positions.

This report was broadly in line with my expectations that the economy is slowly cooling off due to the intense pressures of high rates and uncertainty over federal trade policy. On the upside, the economy continues to bend, but is not breaking and that should continue to allow modest consumer spending. However, business confidence is not high given the tariff situation and we’re likely to see further erosion in the job market over the next several months. This will lead to the economy approaching stall speed by late summer.

Canadian Employment Report

The Canadian economy added just under 9K new jobs in May, and the unemployment rate ticked marginally higher to 7%. The big winners in the labor market during the month were wholesale trade, information, and finance. On the downside, public jobs were down sharply due to the reduction in temporary election workers, but lodging, warehousing, and manufacturing also lost jobs. Construction employment was down 7.4K.

The Canadian economy continues to reel from the impact of tariffs and will continue to do so until the situation is resolved. The pain, though, isn’t equal. Ontario continues to take the impact head on while the resource-rich provinces like Alberta are treading water. Overall, though, the Canadian economy continues to face the significant risk of recession.

Bank of Canada (BoC) Policy Decision

What I’ll Be Watching This Week

In the U.S. we’ll get an inflation reads with the Consumer Price and Producer Price Indices the University of Michigan Consumer Sentiment Survey. In Canada, building permit data will be released.

What I Watched Last Week

I’m a sucker for travel shows, even more so for trains. My bucket list includes The Ghan in Australia, The Rovos in South Africa, and the Maharajas’ Express in India. Thanks to this series I’m adding Royal Scotsman!

How Can I Help?

I’m taking on a limited number of clients to help with bespoke analysis of the economy and construction and what it means for your company. I’m also available if you’re in need of a speaker at an event or someone to come talk to leadership groups on the state of the economy, demographics, real estate, and construction.

If you want to discuss either option, sign up for a spot on my calendar.

Do you know someone who would benefit from the information in this newsletter? Please share the sign up link with them.