Week of March 31

On A Razor’s Edge

After months of anticipation, we finally have a better sense of President Trump’s tariff plan. To be honest I’m not sure how to characterize it. It was good-ish news in the sense that deeper tariffs on Canada and Mexico did not materialize, but the breath, depth, and magnitude of the tariffs on other countries was startling.

The short-term implications I think are pretty clear. Economic activity is likely to slow as consumers and businesses pull back spending in response to higher prices. Employment growth will ease, and most sectors will feel a slowdown. Over the longer term though this could lead to increased investment in the U.S. – but that’s years in the making.

Is this recession worthy? That’s a tougher question to answer, since while we know the plan now, we don’t know how long it will be in place. If countries make immediate changes to their trade stance will the tariffs get reduced/removed in kind? China has already announced retaliation; will that lead to even higher tariffs from the U.S.?

There’s still a lot in play here, but it does feel like we’re walking a tightrope.

Important Data Points From The Past Week

U.S. Construction Spending

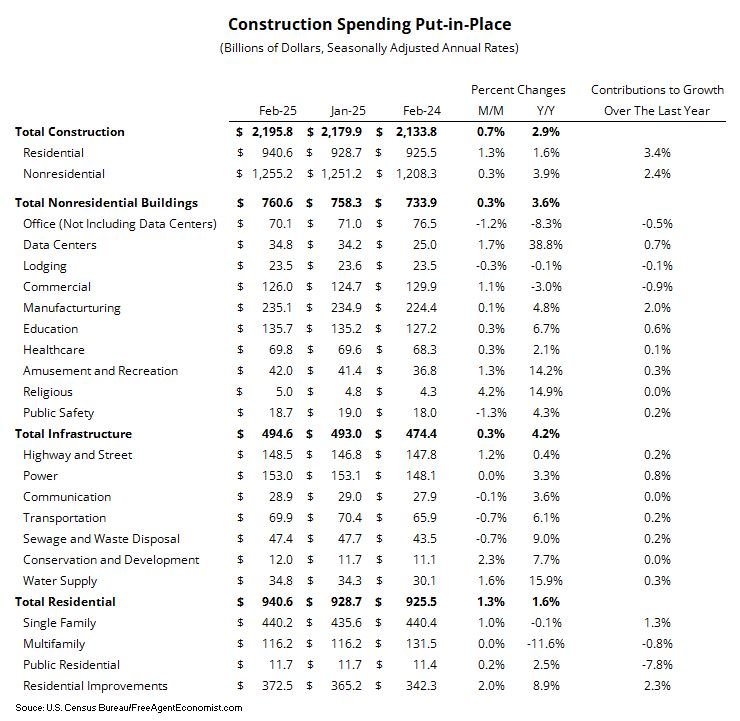

Total construction spending rose 0.7% from January to February to a seasonally adjusted annual rate of $2.195 trillion. Residential spending rose 1.3% in February, while nonresidential spending climbed 0.3%. On a year-over-year basis, total construction spending rose 2.9%; with nonresidential spending up 3.9% and residential spending up 1.6%.

The largest contributors to the gains in February were residential improvements (+2.0%), data centers (+1.7%), highway and street (+1.2%), commercial (+1.1%), and single family (+1.0%). On the downside, traditional office spending (i.e. office excluding data centers) (-1.2%), transportation (-0.7%), and sewage and waste (-0.7%) held back headline growth.

The risk is certainly to the downside over the next few months as developers are likely to pull back on construction plans due to tariff concerns. This notion is backed up by the moribund readings for the Dodge Momentum Index and the continued weakness in the AIA Billings Index. Construction spending will slow throughout the year and the February data has given me no reason to change my forecast of +4.7% spending growth in 2025 – down from the 6.6% gain in 2024. The tariffs have me thinking, though…

We finally have some clarity from the Trump administration on tariffs. To summarize:

Starting April 5, all countries will face a 10% tariff

Starting April 9, reciprocal tariffs will apply to around 60 countries that run large trade deficits with the US. These will remain in place until “progress has been made” on reducing the trade deficit

The President is willing to implement additional tariffs if countries retaliate

Reciprocal and base tariffs will not be stacked on top of sectoral tariffs like on steel, aluminum, and motor vehicles and parts

For now Canada and Mexico are off the hook on the reciprocal tariffs

This could have been worse … this could have been better. At the minimum though I would consider that the knowledge of a plan is at least a positive - at least now companies know what they are up against and can retool their strategies. Granted, all of this could get better or worse on a whim.

Over the last 12 months, roughly 84% of all building material imports came from the countries listed in the table, and all are subject to the additional tariffs. Obviously, some get even due to the steel and aluminum duties and the like. All in though, this will have a profound impact on construction activity. We’re likely to see construction activity slow substantially in the months to come, which will be reflected in the spending data by the fall. Before the tariffs my forecast for total construction spending in 2025 was +4.7% with a lower bound of +2.9%. Both will move lower, but I don’t think spending will contract in 2025. 2026? Maybe, depends on how long these tariffs are in place. Recession inducing? Potentially, again, depending on longevity. Buckle up.

U.S. Tariff Announcement

U.S. Employment

The U.S. economy added 228K new jobs in March and the unemployment rate ticked higher to 4.2%. Not surprisingly, federal employment fell (4K job cuts), but employment was also lower in durable goods manufacturing, mining, and information. Lots of positivity though in sectors like education and healthcare, leisure, and hospitality, transportation and warehousing, retail, and construction. This was a very good report!

Construction jobs rose by 13K, just a bit lower than the 12-month average. Specialty trades were the bookends this month, residential specialty trade employment was down 13K, while nonresidential specialty trades were up by 19K. Residential and civil jobs were also higher. As I mentioned above, construction spending will slow over the course of the year and the tariffs announced on Wednesday may very well accelerate that trend and lead to falling construction employment.

Canadian Employment

The Canadian jobs report was not good, with the employers cutting 33K jobs in March – this was the worst Canadian employment report in three years. Economic sentiment in Canada has plunged alongside the on-again/off-again tariffs and employers are clearly jittery. Most of these declines were in Ontario and Quebec – the provinces that are likely to take it on the chin due to tariffs. This report will certainly create shockwaves. It will weight heavily on the election at the end of the month that could decide how firm Canada is in fighting back. Businesses are likely to see this and further retrench, and finally the Bank of Canada will likely save its dry powder in anticipation of further cuts down the road should the economy worsen.

What I’ll Be Watching This Week

There are two inflation reads in the U.S. this week – CPI and PPI, and while I don’t normally pay much attention to consumer sentiment surveys the U of Mich reading on Friday may be interesting. In Canada we’ll get building permits.

What I Watched Last Week

A murder mystery in the White House and no one can leave until its solved. It’s very well written and good for a laugh or three.

How Can I Help?

I’m taking on a limited number of clients to help with bespoke analysis of the economy and construction and what it means for your company. I’m also available if you’re in need of a speaker at an event or someone to come talk to leadership groups on the state of the economy, demographics, real estate, and construction.

If you want to discuss either option, sign up for a spot on my calendar.

Do you know someone who would benefit from the information in this newsletter? Please share the sign up link with them.